Is your month-end in chaos? Are you getting numbers on which you have no confidence? It’s a reality that all businesses in the USA are facing. We understand how stressful the financial close process has become for you. It was supposed to bring clarity, but instead, it is bringing in more pressure.

As per multiple surveys, almost 50% of CFOs are of the opinion that financial close has become too manual and time-consuming and requires automation in 2026. Plus, the manual financial close process is an invitation to risk at every level: misstatements, audit delays, and a lack of confidence from external stakeholders.

The problem isn’t effort. It’s the way you are doing things.

Let’s unpack the financial close process in detail and how to fix the challenges it faces via automation.

What Is the Financial Close Process?

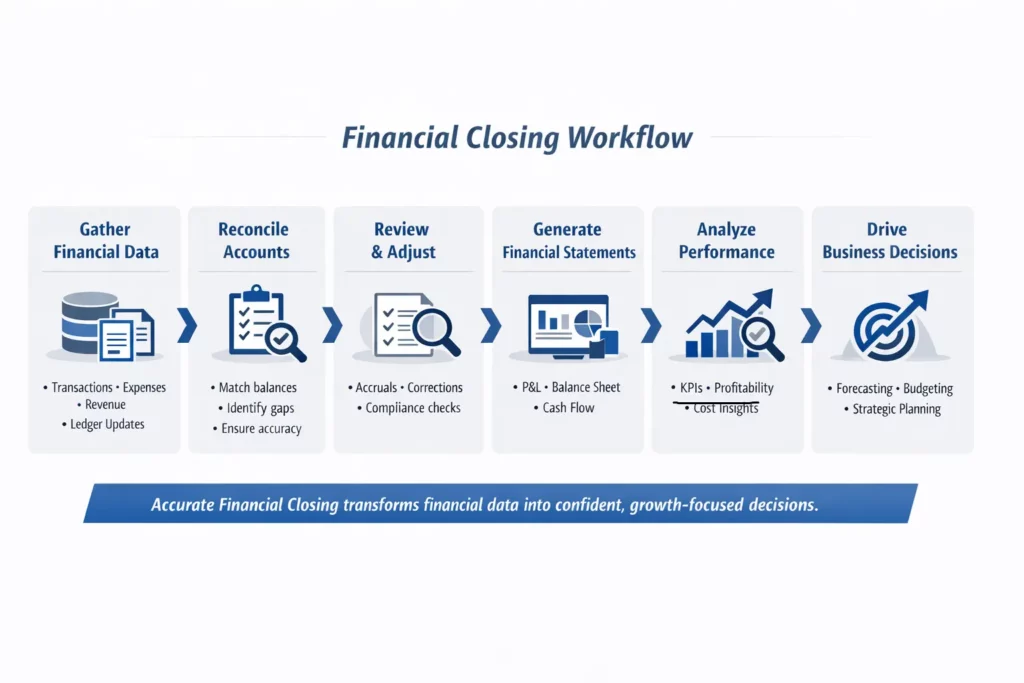

Financial close process is a critical accounting aspect that verifies, adjusts, and finalizes accounts balance at the end of the reporting period, which can be monthly, quarterly, or yearly.

The ultimate goal of this process is to record, reconcile, and report accurate financial numbers, which will be used for generating accurate and compliant financial statements. These statements serve as the foundation for audits, performance reviews, strategic decision-making, and regulatory compliance.

Why Accurate Financial Closing Is Essential for Business Success?

The importance of an accurate financial closing is such that both your internal departments and external stakeholders depend on the end product, financial statements, for future course of action. These statements are nothing but a gold mine of data.

You will be analyzing the financial statements closely to do financial analysis, forecasting future income and expenditures, adjusting budgets, getting key performance indicators, and more.

Stakeholders in your business, such as investors and lenders, will be interested in your financial statements generated during the close process to assess your business performance and make informed investment decisions.

PwC’s Global Finance Benchmarking Report shows that companies with faster and more accurate financial closing are more likely to make proactive strategic decisions. In short: speed + accuracy = competitive advantage.

Key Steps to Complete a Financial Close Process

You don’t want to be caught off guard in a financial close process. A well-thought-out financial close process will eliminate risks, speed up consolidation, and give stakeholders confidence in the numbers generated.

Here’s what a well-designed financial close process typically includes:

Step 1: Record and Capture All Transactions

Business is full of buying and selling goods and services, and these transactions must be recorded accurately. Sometimes these transactions are not recorded on time or in different systems. Your teams must get the data from these systems to get a full picture. It’s not just getting the data entry right; it’s laying the foundation for the entire financial close.

Step 2: Perform Account Reconciliation

Cannot take the recorded transactions on face value. Therefore, it is important that accounts payable, accounts receivable, and cash balances be matched with bank statements and other supporting documents. If any mismatch comes up, then it must be addressed immediately, before the auditor or regulator notices it.

Step 3: Adjust Journal Entries and Run Trial Balance

Accounting standards and timing differences require adjustments. Your accounting team will need to update on accruals, deferrals, write-offs, and more, then run an adjusted trial balance to ensure accuracy before financial statements are generated.

Step 4: Review and Analyze Financial Results

Now that your numbers have been reconciled and adjusted, it’s time to review the story. Your accountants will analyze the statements generated, the profit and loss statement, the balance sheet, and the cash flow statement. In this step, your accountants will see the statements’ compliance, consistency, and any issues that need resolution.

Step 5: Combine Financial Statements

After analyzing all the numbers, they must be consolidated into a set of financial statements, which will give you an accurate financial picture.

Step 6: Close the Books

Temporary accounts are cleared, and balances are moved to retained earnings. This formally closes the reporting period and locks the data, preparing the system for the next cycle.

Step 7: Sending Financial Statements to Stakeholders

The final financial statements are distributed to your stakeholders, investors, executives, and auditors. These statements enable them to make informed strategic decisions, conduct performance reviews, and ensure compliance is followed.

Common Financial Close Challenges Businesses Face

Are you unable to close books on time? Blame not your expertise or hard work, but the process, which has not evolved. Even today, many businesses prefer to follow a highly manual financial close process. Naturally, that throws up some common challenges that create a hindrance in the financial close process.

Inconsistent Processes

It has been noticed that many businesses do not follow a standardized closing process. Instead, they depend on ad hoc routines and institutional memory, which leads to task duplication, errors, and frequent missing of timelines.

Manual Work Increases Error Risk

The manual financial close process consists of spreadsheet trackers, email follow-ups, and one-by-one reconciliations. Accountants are often busy searching for relevant documents across the system, leaving gaps in oversight and audit readiness.

Time-Consuming End-Loaded Work

Key inputs like purchase orders, sub-ledger entries, and expense reports often arrive only at period-end. This backlog compresses the entire financial close process into a tight window, forcing your teams to rush and raising the chance of missed entries or late adjustments.

Disconnected Systems

When you are working on the financial close process on disconnected systems, information silos emerge. There will be no other option but to intervene manually to bridge the gaps, thus affecting the overall efficiency of the entire financial close process.

Lack of Visibility

Without a central dashboard to monitor close progress, you are not in a position to identify delays or recurring mistakes. Scattered data makes improving the closing process difficult.

7 Proven Strategies to Improve Your Financial Close Process

Now that you are aware of the challenges in the financial close process, it’s time to overcome them through solutions. Leading businesses don’t chase deadlines; they create a close process that delivers numbers that are audit-ready and reliable every time. To achieve that, you will need to follow 7 proven strategies.

1. Accuracy Balanced with Speed

Generating financial statements quickly is important, but getting them accurate is no less important; after all, decisions are made based on them. Rushing through the financial close process without proper data verification will increase the risk in the future. Therefore, build checkpoints to ensure numbers are accurate and stand during scrutiny.

2. Automate Repetitive Tasks

Conducting repetitive tasks in a manual way will only invite more errors. Hence, use automation to handle reconciliations, journal entries, and variance checks, so your team can focus on analysis.

3. Standardize the Process

Create detailed SOPs for every step in the financial close process, from sub-ledger validation to expense reporting. Such standardization will remove doubts across teams.

4. Start Continuous Accounting

Speed is critical, don’t leave critical close activities, like reconciliations and accruals, till the month-end. It is ideal to conduct these activities continuously to avoid last-minute pressure and improve control throughout the cycle.

5. Allow Secure Data Access

Delayed access to purchase orders or bank transactions will slow down the close process. Ensure real-time visibility into operational systems so that there are no holdups.

6.Improve Cross-Functional Collaboration

To speed up and streamline the financial close process, you need timely inputs from all your departments. Therefore, align all your employees and departments and ensure accuracy in the data they provide.

7. Review and Update Post-Close

Once the close process is done, take a stock of the error rates, time taken, and deadlines missed. This will help you in identifying gaps and upgrading your process for the next cycle.

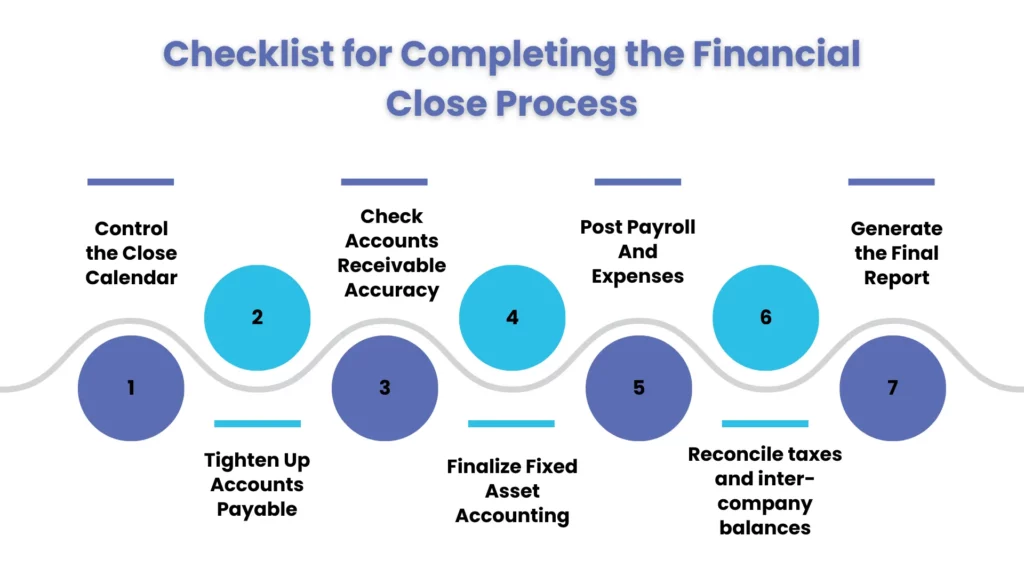

Checklist for Completing the Financial Close Process

When a structured checklist is in place, your accounting team will not be bogged down with delays, missed entries, reporting inconsistencies, and compliance issues. These checklists reduces the complexity of the process while streamlining payables, receivables, payroll, and reporting, making accounting accuracy and speed non-negotiable.

Let’s understand these checklists that will make your close process fast and reliable.

Control the Close Calendar

Open the new accounting period only after confirming that the prior periods’ subledgers have been closed properly. Then sequence the closures, accounts receivables, payables, and general ledgers, with reconciliation guardrails to avoid data leakage.

Tighten Up Accounts Payable

Conduct a run on the purchase and non-purchase order accruals, confirm prepaid vendor general ledger coding, and post vendor payments. To avoid liability errors, ensure the completion of accounts payable and general ledger reconciliations before the closing of accounts payable sub-ledger.

Check Accounts Receivable Accuracy

Ensure the accuracy of sales orders, payments, and revenue postings. Conduct the processing of credit memos and create revenue variance reports. Close the accounts receivable only after receivables and the general ledger are reconciled.

Finalize Fixed Asset Accounting

Post the journal entries for depreciation, transfers, and capitalization entries. Reclassify capital spending and reconcile the fixed assets subledger with the general ledger before closure.

Post Payroll And Expenses

Enter union, exempt, and accrued payroll. Keep a record of all the travel and expenses transactions.

Reconcile taxes and intercompany balances

Reconcile accounts receivable and payable and recurring journal entries.

Generate the Final Report

Once the general ledger is closed, generate financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports created after following the checklist will show the financial reality of your business.

How to Automate the Financial Close Process Efficiently

Many businesses are exploring financial close process automation to reduce manual work, improve accuracy, and shorten close cycles. To achieve that, you can choose from multiple financial reporting tools that will help you in improving matching logic, exception resolution, and general updates autonomously, thereby speeding up close by significantly.

Here’s how financial reporting tools help in transforming every step of the financial close process.

- Ensures Proper Sequencing of Tasks Across: The financial reporting tool will ensure proper order of tasks across your business, send alerts automatically, and ensure nothing is missed in the closing process.

- Accelerate Ledger Reconciliation with Automation: It will keep the subledger-to-GL reconciliation running in the background. This will ensure a reduction in cycle time and eliminate data mismatches during the month-end close process.

- Automates Posting of Recurring Journals: When financial close process automation is done, it will automatically create, validate, and post journal entries without manual intervention. This will free up your resources for high-value close activities.

- Tracking Close Health in Real Time: The automation tool will give you access to a live dashboard that gives a centralized view of open items, overdue tasks, and owner accountability, supporting faster decision-making.

- Identify Irregularities Early: Financial reporting tools with an AI feature will easily flag trends and suspicious entries before they create problems during the closing process.

- Making it Audit-Ready: All tasks done by the financial reporting tool will go through multiple reviews, will be time-stamped, and will be backed with documentation, making the audit ready from the start.

Automation supports compliance with SEC internal control standards (especially under SOX for public companies) and strengthens reporting reliability.

But automation works best when integrated across:

• Procure to Pay Process

• Order to Cash Process

• Record to Report Process

Without alignment, automation only speeds up broken workflows.

To avoid delays and reporting inefficiencies, investing in the right financial reporting tools can streamline every stage of your close cycle.

Close Your Books Faster and More Accurately with Corient

When it comes to automation, we understand that you, like other businesses, will be unsure about what to do. In such situations, you must approach a professional third-party accounting firm with experience in handling AI tools and the closing process. Corient checks the box.

At Corient USA, we help businesses rebuild their financial close process from the ground up.

Our finance and accounting services focus on:

- Streamlining upstream transaction flows

- Strengthening reconciliations and internal controls

- Enhancing reporting accuracy

- Integrating financial reporting tools effectively

- Supporting GAAP, IRS, and regulatory compliance

Instead of struggling through month-end, businesses gain:

- Predictable close timelines

- Clear visibility into financial performance

- Stronger internal controls

- Better strategic insights

When your close is structured, leadership stops waiting for numbers and starts acting on them.

People Also Ask:

What is the financial close process?

It is a structured procedure used by businesses to finalize accounting records and preparing financial statements for a given period.

How long should a financial close process take?

On an average, a professional business closes monthly books within 6 to 7 days, depending on the complexity.

How does financial close process automation help?

It reduces manual errors, improves speed, strengthens compliance, and increases reporting accuracy.

Why do businesses struggle with financial closing?

Because upstream processes (Procure to Pay, Order to Cash) lack integration and control, leading to reconciliation bottlenecks.

Which of the following is a common challenge during period end close?

Some of the most common challenges during the closing process is manual data entry errors, inconsistent processes, delayed reconciliations, and invoice matching issues.

Conclusion:

There is no need to panic about the financial close process if you start investing in automation beforehand. In 2026 and beyond, businesses that modernize their close cycle will move faster, report smarter, and compete stronger.

Automation in the financial close process is here to stay, and choosing the right system will streamline your entire process. And Corient is ready to help you build an automated financial close process that works as hard as your business does.

Decided to automate your financial close process? Start by connecting with us, and we will ensure the entire process is streamlined.