Many businesses fail not because they don’t work hard but due to a lack of insight to make decisions. It’s a fact that many businesses choose to ignore. If you are looking to make your business agile, forward-looking, and actively making adjustments, then you will need to take a close look at your financial reports.

Financial reports provide you with those insights that will give you confidence while making a decision. It’s also a set of documents which your stakeholders will be very much interested in taking a look. The documents provide them with numbers based on which they know how the business is doing and what investment decisions they need to take.

In this guide, we’ll break down what stakeholders really look for in financial reporting, how to read your financial statements beyond surface-level totals, and how modern financial reporting tools can turn your reports into business intelligence.

What is Financial Reporting

Financial reporting is the method of collecting, summarizing, and presenting financial accounting data that will enable you and your stakeholders, lenders, and US regulators to evaluate your business:

- Financial performance

- Profitability

- Cash flow health

- Risk exposure

- Compliance status

In the US, financial reporting is closely tied to standards and regulators like:

- GAAP (Generally Accepted Accounting Principles)

- SEC reporting for public companies

- IRS compliance for tax reporting

- Industry standards for audits, controls, and disclosures

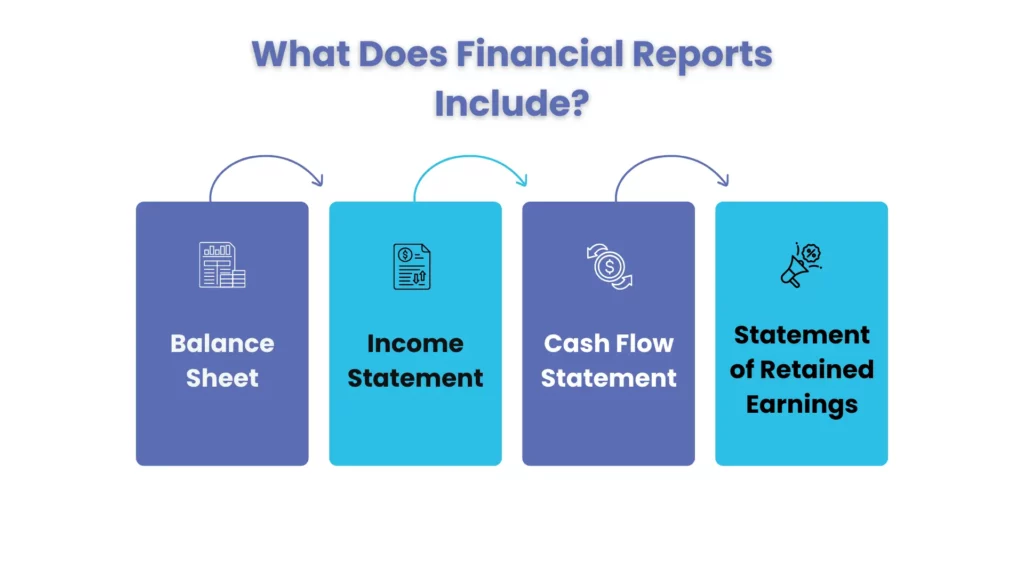

What Does Financial Reports Include?

Financial reports are a set of documents that contain the financial performance of your business. It contains the financial data of what you owe and own, profits, and expenses.

Financial reports are made of four main financial statements:

Balance Sheet

A balance sheet displays what your business owns and how much it owes at a given period. It is based on the equation:

Assets = Liabilities + Shareholders’ Equity

Income Statement

Also known as a profit & loss statement, it shows the profitability of your business by showing how much your business earned and its expenses.

Cash Flow Statement

The cash flow statement, sometimes called a statement of changes in financial position, shows how money, including cash equivalents, has moved through your business during the period.

Cash flow statement gives a detailed picture of the cash movement during business operations, investments, and financing.

Statement of Retained Earnings

The Statement of Changes in Equity reports on a company’s changes in retained earnings after dividends are distributed to stockholders. It allows stakeholders to see what factors caused a shift in owner’s equity during the accounting period.

Statutory Reports vs Management Reports: What Makes Them So Different

A lot of businesses make the assumption that its enough to just churn out GAAP-compliant financials. But that just scratches the surface

| Aspect | Statutory Financial Reports | Management Financial Reports |

| Purpose | Designed to keep the regulators, accountants and auditors happy | Designed to help the decision makers |

| Focus | Based on the past and are compliance driven | Forward looking and operational |

| Reporting Frequency | Prepared quarterly or every year | Prepared monthly or more often |

| Customisation | They are standardized , not tailored to the business needs | They are tailored to the business priorities |

Management reports answer questions that statutory reports can’t possibly cover:

- How long can we keep going without needing more funding?

- Where are the margins going up or down?

- Which customers or products are driving profitability?

- What risks might be building up that we haven’t noticed?

Stakeholders want management insight, not just the basic compliance output.

Stakeholders’ Key Concerns and What They Look for in Financial Reports?

Your stakeholder is very much interested in the financial reports you provide, not because they enjoy it, but to know the danger that lies in the numbers. Your business will have multiple stakeholders, and each of them will be looking for different kinds of dangers.

Investors

Your investors will invest more in your business only if they are confident about returns on investment. When they look at the financial reports they will look for:

- Growth rate & margins

- Runway (cash burn)

- Revenue quality (one-time vs recurring)

- Predictable unit economics

Banks and Lenders

Banks that have given business loans to your business will be interested in getting their money back. They will take a look at the reports to find out:

- Growth rate and margins

- Runway (cash burn)

- Revenue quality (one-time vs recurring)

- Predictable unit economics

What Banks and Lenders actually Care About?

Lenders aren’t typically looking for growth, they are looking for certainty that the money will be paid back.

They keep a close eye on:

- How well a business can cover its debt repayments

- The liquidity of the business, its cash safety net

- When the cash comes in, not just how much

- Compliance with the loan covenants

- How reliable the reporting is

For lenders a business that has a strong cash flow always beats one that has got aggressive growth.

Regulators

US regulators like the IRS and SEC are more interested in seeing your financial reports to find whether you are compliant with rules and regulations and whether you have the proof to back it up. Here’s what the regulator will be looking for in the reports:

- Accuracy

- Internal control reliability

- Consistent reporting practices

- Compliance with GAAP and reporting rules

Why Accurate Reporting is Critical for Business Success

Accurate financial reports or financial statements are absolutely critical for the success of your business and are vital tools for building your business.

Here are the reasons why:

Future Planning

Financial statements are used for strategic planning, budgeting, and forecasts. You can use these statements to see how your business is performing, identify trends, compare your financial performance with the target set, budgets and forecasts. Based on that, you can make plans for your business future.

Helps Stakeholder in Making Investment Decisions

Financial statements are treasured by your stakeholders who can be lenders, investors or partners. It helps them in understanding the business’s financial health and, based on that, make their decision to invest or hold it.

Assisting Tax Filings

Financial statements are also used to prepare annual tax filings, in other words, your tax returns.

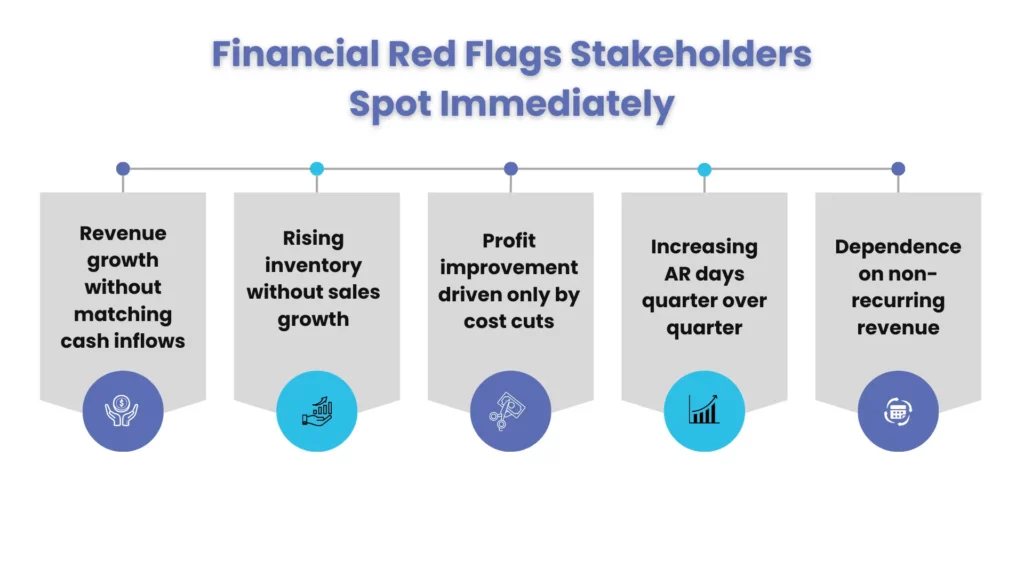

Financial Red Flags That Stakeholders Spot Right Away

Experienced stakeholders can tell when a business is heading for trouble long before things get really bad

Common red flags that make them go ‘oh no ‘ include:

- Profitability is going up but cash is going down

- Receivables are getting older than 60-90 days

- The accounting books have to be heavily massaged with manual journal entries

- They keep making big month end adjustments without a clear explanation

- Costs are going up fast but the revenue just isn’t keeping pace

- Inventory levels are building up fast but sales are not

These signals start to raise much bigger questions:

- Is the leadership in control?

- Are the systems reliable?

- Can anyone really trust the forecasts?

Once the confidence starts to slip, capital gets a whole lot harder to get or its priced so high its just not worth having.

When Should You Create These Financial Statements?

There was a time when financial statements were prepared once a year, but now it’s outdated. Due to fast-changing business scenarios, monthly and quarterly statements have become vital. The majority of businesses prefer going with quarterly financial statements because they give them vital inputs of their performance with a sufficient time gap, and identify the least performing areas and rectify them beforehand.

How To Read Your Financial Report?

Let’s make this real.

Imagine two companies.

Company A

Shows a healthy profit on the P&L: $180,000 net profit.

CEO feels great.

But their AR aging report shows:

- 40% receivables are sitting past 60 days

- increasing unpaid invoices

Their cash flow statement shows negative cash flow.

Translation:

• They’re profitable on paper but cash-starving in reality.

Company B

Shows lower profit: $80,000 net profit.

CEO feels worried.

But their cash flow statement is strong:

- Collections are faster

- controlled expenses

- tight working capital

Translation:

• Company B has better financial control and scalability.

This is why Financial Reports need interpretation.

Why Forward-Looking Reporting Matters More Than Historical Results

Historical reports explain where your business has been. Forward-looking reporting shows where it’s going—and that’s what investors and leadership teams care about.

This includes rolling 12-month forecasts, short-term cash flow projections, scenario planning, and sensitivity analysis. Together, these insights help businesses anticipate funding needs, adjust strategy early, manage emerging risks, and make smarter growth decisions.

In volatile markets, forecasting isn’t optional—it’s how businesses stay in control.

How Technology Streamlines the Reporting of Financial Statements

These days, financial statements are prepared using technology, and when thinking of the benefits of it, the first thing that will come to your mind is efficiency and speed, and it’s true. Financial technology, like digital spreadsheets and blockchain transactions, has simplified aspects of financial reporting significantly.

But efficiency without accuracy means nothing, and you can only have confidence in the financial statements when you have complete faith in the data. That faith can only come when technology is used to limit human errors.

Here are some tools that help in streamlining financial statements.

- Reporting dashboards like Power BI

- Accounting platforms like QuickBooks and Xero

Key benefits include:

- Automated reconciliations

- Real-time reporting

- Reduced manual errors

- Faster month-end close

- Better stakeholder transparency

You can get access to these technology without having to buy it by partnering with an accounting firm. To understand more see the blog on how tech provided by accounting firms can empower your business.

Internal Controls: The Bedrock of Trustworthy Reporting

Automation speeds things up, but without strong controls, fast numbers can still be unreliable. Trustworthy financial reporting depends on clear approvals, segregation of duties, timely reconciliations, and solid audit trails. These controls ensure accuracy, accountability, and consistency. Without them, even correct numbers fail to inspire confidence.

How Financial Reporting Standards Are Evolving and What It Means for US Businesses

Want your financial statements to be credible in the eyes of your stakeholders? Then make sure it is aligned with US reporting standards.

Here’s what’s shaping reporting today:

- US GAAP: This standard ensures consistency and comparability of reporting across businesses.

- IRS Reporting: Along with accuracy, your financial records must align with the IRS reporting standards, especially when scrutiny is rising.

- SEC Requirements: If your business is a public company then it will be subject to reporting deadlines and disclosure requirements.

- Tax Reform Pressures: Changes in tax treatment can impact profit reporting and forecasting assumptions.

- ESG Reporting: Environmental, Social, and Governance reporting is becoming increasingly important for enterprise contracts and investor transparency.

How Finance and Accounting Services Add Value?

We agree with you that preparing compliant and accurate financial statements requires expertise in tools and the US regulatory framework, not to mention the complexity involved in it. All this makes the preparation of financial statements, even after using the latest tools, time-consuming.

That time consumed can be saved for:

- Forecasting

- Analysis

- Strategic decisions

That’s when finance and accounting services come in adding value to your business, especially when you need:

- Clean month-end close

- Accurate financial packs

- Structured reporting templates

- Scalable reporting operations

You can get access to these finance and accounting services by partnering with professional accounting firms. So, choose the right accounting Solution and avoid making common mistakes while choosing one.

Common Financial Reporting Mistakes That Kill Confidence

Even really big and mature businesses can make avoidable mistakes:

- They get too caught up in the P&L, and forget about cash flow

- They ignore the timing of when cash comes and goes

- They only do reporting once a year – and then wonder why it’s not helping them make decisions

- They leave reconciliations till the last minute – which is just asking for trouble

- They build their reports on spreadsheets, without any controls in place

- They churn out report after report, but forget to actually add any analysis or narrative

The result is reports that are just taking up space

What Stakeholders Really Want from Your Financial start being a valuable strategic asset.

People Also Ask:

What tools are best for creating monthly finance reports?

Our suggestion would be use QuickBooks, Xero, and Power BI but the final choice will depend on your business size and report requirements.

Where can I find detailed financial data and analysis?

You can get your detailed financial analysis through your accounting platform + reporting dashboards. Also, you can use the services of a financial specialist who will do the financial reporting work for you.

What tools are best for managing construction financial reports?

Construction businesses often benefit from job-cost accounting tools like QuickBooks Enterprise and Power BI dashboards for project margin tracking.

Why is financial statement analysis important for stakeholders?

Financial statement analysis is essential because it transforms raw financial data into clear, actionable insights. Without it, decision-making becomes guesswork.

What are the four important financial reports?

Financial reports are made of four main financial statements:

• Balance Sheet

• Income Statement

• Cash Flow Statement

• Statement of Retained Earnings

Conclusion

Let’s put this bluntly: your stakeholders are not interested in the form of financial statements. All they want to know is:

- Is the business stable?

- Is leadership in control?

- Is growth sustainable?

- Are numbers clean enough to trust?

That’s what makes Financial Reports powerful, when they become insights, not paperwork. At Corient, we help businesses transform financial reporting into actionable intelligence through high-quality bookkeeping, month-end close support, management reporting, and scalable finance operations.

Facing problems in getting the right financial report on time? Connect with us and see the sea change in the report which your stakeholders will experience.