Are you stuck with your customers who are not paying for the products or services you sold, thus impacting your cash flows? This problem can be solved if you get your accounts receivable sorted, which is a critical component of a healthy financial ecosystem for businesses worldwide.

With more than 60% of small businesses struggling with cash flow management, it’s important to manage accounts receivable well and enjoy its benefits. In this blog, we will explain accounts receivable in detail, discuss its importance, its impact on cash flows, and why you need to manage it effectively for your business’s survival.

What is Accounts Receivable?

Accounts receivable refers to the unpaid amount that your customers need to pay for the products or services purchased from your business. Under it comes the responsibility of collecting the payments from the customers, which is why the accounts receivable team keeps a track of unpaid invoices to ensure timely payments. Clear payment terms such as Net 30 or Net 45 help US businesses set expectations and reduce delays.

Until the unpaid amount is received, it will sit on your balance sheet as accounts receivable.

The Role of Accounts Receivables in Financial Accounting

According to the IRS recordkeeping guidelines, businesses must maintain accurate accounts receivable records to ensure proper financial reporting and compliance under accrual accounting. Under US GAAP accounting standards, accounts receivable play a crucial role in measuring the short-term financial health of your business.

• Accounts receivable will be recorded as a current asset

• Directly impacts working capital

• Affects liquidity ratios and financial reporting accuracy

US-based businesses use accrual accounting, and under it revenue is recognized when it is earned, not when cash is received. This makes accounts receivable an important link between revenue and cash flow.

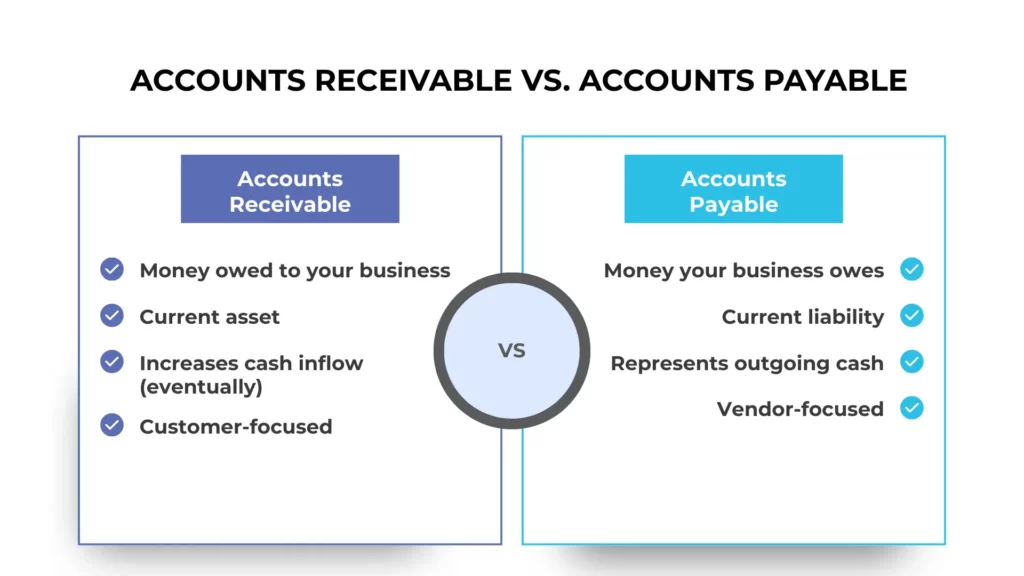

Accounts Receivable vs. Accounts Payable

Both accounts receivable and accounts payable are two opposite sides of cash movement. Let’s do a comparison of Accounts Receivable vs Accounts Payable and see the difference.

| Accounts Receivable | Accounts Payable |

| Money owed to your business | Money your business owes |

| Current asset | Current liability |

| Increases cash inflow (eventually) | Represents outgoing cash |

| Customer-focused | Vendor-focused |

How This Affects Your Cash Flow

Like accounts payable, accounts receivable has a significant impact on the cash flow of your business. Accounts receivable are recorded as assets and point towards a future cash influx. However, it is important not to let your accounts receivable balance get out of hand. When the receivable figure becomes too high, your business will face a liquidity crunch.

The only way to prevent it is to establish an AR process, or you can choose an accounting partner and avail their order to cash services to handle accounts receivable process for you. A streamlined, easy, and well-planned accounting process means increased payments that are also made on time.

Why Accounts Receivable is Important

The importance of accounts receivable to your business can be gauged from the fact that it impacts your cash flow and financial stability. It is a crucial aspect of financial management that can make or break your business.

Here are a few reasons why AR is important:

Positive Cash Flow

Keeping the money flow stable is important for your growth and stability. When receivables are managed perfectly, you will be better positioned to invest in growth, pay off debts, and meet operational needs, leading to profits. Accounts receivable strengthen your balance sheet, showing your ability to collect payments from your customers.

Healthy Business Relationships

When your customers pay their invoices without any delays, it’s a sign of healthy business relations. Such a health relation is possible only when enough trust is generated.

Liquidity

Successful accounts receivable management will have a positive impact on the liquidity of your business. Many financial institutions keep a close eye on a business’s accounts receivable to determine its creditworthiness.

Predictable Revenues

When less time and energy are spent on collecting payments, more can be spent on growth, innovation, and other business activities. A streamlined accounts receivable process will ensure predictable cash flow and promote financial planning.

Best Practices for Managing Accounts Receivables

There are many ways to improve your accounts receivable process, and one of them is through incorporating the best practices. Some of these best practices are:

Establish Clear Policies

Create and communicate clear policies to your customers. Clear expectations help prevent delays or misunderstandings and strengthen business relationships.

Offer Discount for Paying Faster

Offer your customers a lower price in return for speedy payment for the goods or services purchased from you.

Penalize Customers that Don’t Pay On Time

Start penalizing customers who pay late; this will motivate them to make payments on time. But before implementing it, communicate it well with your customers so that they are on board before it starts.

Streamline Invoicing Processes

Make sure you are sending accurate invoices immediately after delivery. Such quick and error-free invoicing will help speed up the payment process and minimize disputes.

Improve Payment Processing

Fast, accurate payment application improves customer satisfaction.

Monitor and Manage Proactively

Conduct frequent account reviews and follow-ups to prevent collection issues. Professional and consistent communication with your customers encourages payment priority.

What Accounts Receivable Can Tell You

Apart from showing insights on cash flow, Accounts receivable will also help you in understanding the behavior of your customers, its impact on your finances, and help in streamlining your process.

Let’s take business A and B to understand better. Every month, businesses A and B perform the same number of sales: $40,000. However, Business A’s accounts receivable are at $12,000, and Business B’s receivable are at $6,000. The reason for this difference is due to customer behavior. Customers of business B pay up promptly.

What conclusion can you remove from it?

Business B’s collections process is more streamlined than Business A’s. If you’re Business A in this scenario, you should improve your process either through investment in your AR team or by partnering with a service provider for accounting services.

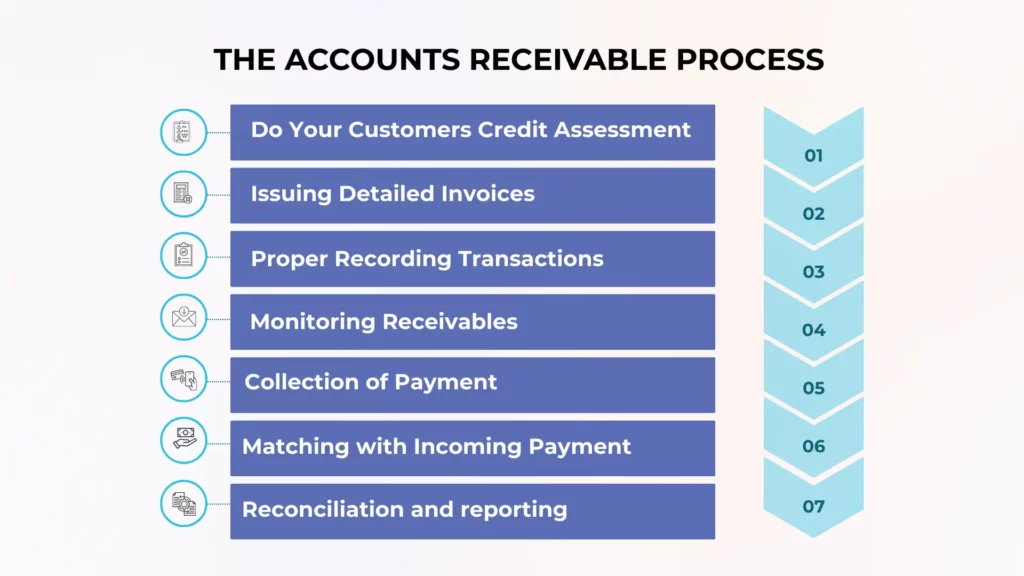

The Accounts Receivable Process

Accounts receivable consists of several key steps, and each step contributes toward effective cash flow management.

Do Your Customers Credit Assessment?

Before extending credit to your customer, verify their financial stability and payment history. This will prevent future payment issues and lay the foundations of a strong customer relationship.

Issuing Detailed Invoices

Once you have delivered the goods or services, immediately send detailed invoices that clearly show what was purchased, the amount due, and payment terms. Accurate and timely invoicing will speed up the payment process and reduce disputes.

Proper Recording Transactions

Every invoice must be recorded in your accounting system as accounts receivable. Accurate records create an accurate picture of expected incoming payments and help track your business’s financial health.

Monitoring Receivables

Keep a track of outstanding invoices through reports that show how long the payments are due. Such visibility helps in spotting potential issues before they impact the cash flow.

Collection of Payment

Always follow a system of collecting outstanding payments through reminders, calls, or payment plan discussions. Such a professional approach will help in maintaining good customer relations and cash flow.

Matching with Incoming Payment

Make sure to match the incoming payments with their invoices. This step will maintain accuracy and give you real-time visibility into your cash position.

Reconciliation and reporting

Compare your AR records with bank statements and generate reports on receivables performance. This analysis helps you identify process improvements and make informed financial decisions.

How Accounts Receivable Solutions Help Businesses

We understand the lack of time or talent in handling accounts receivable that you must be facing. The good news is that modern and affordable accounting solutions have managed to bring down manual work and speed up collections.

Some of these modern accounts receivable solutions are:

• Automating invoicing and reminders

• Providing real-time visibility into receivables

• Tracking aging and payment trends

• Integrating with accounting systems

Many of these solutions can be availed through our accounting services, which will free up your internal teams from constant follow-ups while improving cash flow.

Choosing the Right Accounts Receivable Strategy

Creating the right accounts receivable strategy depends on the following factors:

• Your business size and transaction volume

• Customer payment behavior

• Internal resources

• Growth plans

Some of your counterparts manage receivables in-house through automation tools. At the same time, others choose to outsource accounts receivable to increase efficiency and reduce operational burden. The goal should be to choose a strategy that will stabilize your cash flow without adding stress.

People Also Ask:

Are accounts receivable assets or liabilities?

Accounts receivable are considered assets because they represent revenue that will be paid soon.

How do you record accounts receivable?

Accounts receivable must be recorded in the current assets section of your business’s general ledger.

What are the 4 types of accounts receivable?

The four types of accounts receivable are trade receivables, or accounts reflecting the sale of goods or services; non-trade receivables, or accounts not related to the sale of goods or services, like loans, insurance claims, and interest payments; secured receivables, which are backed by collateral and enshrined by a promissory note; unsecured receivables, which are not backed by collateral.

What is the difference between accounts receivable vs payable?

Under accounts receivable, money is owed to your business by your customers; under accounts payable, your business owes money to others.

Why are accounts receivables important for cash flow management?

It represents the money owed to your business and when managed properly will ensure smooth inflow of cash.

Conclusion

Accounts receivable is the engine that will keep cash flowing through your business. When managed well, it propels your growth; when neglected, it drains you quickly. Therefore, it is important to prioritize accounts receivable management to weather uncertainty, fund expansion, and operate with confidence.

We understand that handling rising accounts receivable volumes and complexity will be too much for your accounting team. This is where partners like Corient steps in offering support to businesses by managing accounts receivable processes end-to-end. We ensure invoices go out on time, collections are tracked consistently, and leadership has clear financial visibility.

Are you interested in fine-tuning your accounts receivable process? Add your requirements to our contact form and see the difference.