Did you start a business to chase unpaid invoices? Certainly not. Yet, we have noticed countless US businesses facing the cash flow problem, not because of low sales but due to a slow, leaky order-to-cash process. Unfortunately, it’s becoming the norm.

However, this problem can be solved by having a streamlined, automated order-to-cash process cycle that can deliver a range of benefits, including better cash flow and happier customers. Surveys across finance teams consistently show that late payments and invoicing errors are among the top causes of cash flow stress, especially for small and medium businesses.

To overcome this situation in 2026, you need to work smarter, not harder, by optimizing your order-to-cash process system. This blog will help you in achieving just that by explaining what order-to-cash is, its importance, challenges, and its future.

Let’s dive into it.

What is order to cash?

Unlike procure-to-pay process, which deals with businesses, order-to-cash process starts with the customer’s order and ends when the payment is made.This process contains multiple aspects like order management, submission if invoice, payment processing, and accounts receivable. This process can be time-consuming, and if you manage to speed it up, through automation, you will be able to boost your cash flows.

Why Is Order-to-Cash Important?

Because it’s the oxygen that your business breathes, and rightly so. Order-to-cash directly impacts the financial health of your business. When the time gap between order placement and the receipt of payment disappears, your funds start flowing quickly. With the arrival of funds, you will be in a position to invest in your growth.

It will surprise you to know that even profitable businesses are known to suffer from an inefficient order-to-cash process. That makes the order-to-cash process very important and worth your attention.

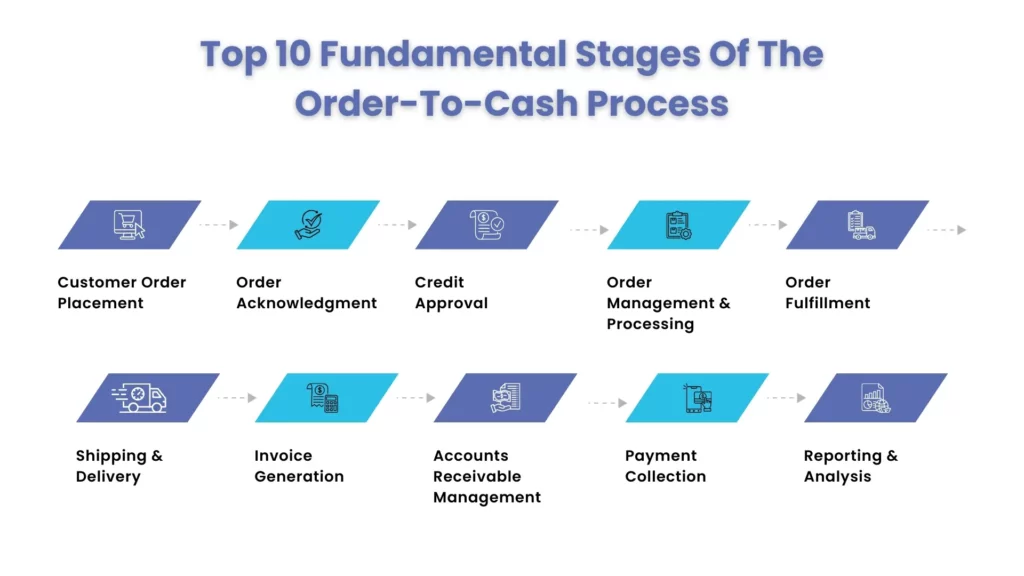

Here Are The Ten Fundamental Stages Of The Order-To-Cash Process

An order-to-cash process can be termed as successful only with the successful delivery and payment. Achieving that looks simple, but to get to that finish line, you will need to have communication and coordination. For that, you will need to know the steps that are included in the order-to-cash process, which starts with the customer placing an order.

Customer Order Placement

The purchasing process can start with a simple online order or complex sales that need talking with a sales associate and multiple internal approvals. You will need to capture all the relevant information, from product specifications to delivery requirements, to initiate efficient order processing and fulfillment.

Order Acknowledgment

Once the order is placed, a confirmation is sent, terms are clarified, and timelines are set.

Credit Approval

If your customers have applied for credit, then your system must confirm their eligibility internally or through partners. This step helps in minimizing losses by creating appropriate credit limits based on the customer’s payment history as well as current financial and market conditions.

Order Management & Processing

With credits sorted, the orders will be entered into the system and routed correctly.

Order Fulfillment

Under order fulfillment, the process of picking and packing the ordered item starts. It means getting the right item from the inventory, assembling any custom configurations, and preparing for shipping. To execute the step, you will need to coordinate with warehouse management systems and have clean interdepartmental communication to support accurate and timely delivery of ordered goods.

Shipping & Delivery

The next step will be to notify your customers about the estimated date of arrival of their delivery. It’s important to note that shipping can get complex because it involves finding the right prices and shipping modes, especially if you are into international trade. You can quicken the process by automating customer notifications, generating tracking numbers, and monitoring delivery progress.

Invoice Generation

One way of speeding up the order-to-cash process is by prompting the generation of invoices. Prompt invoicing helps in streamlining the cash flow since your customers cannot pay until they receive one. To speed up the invoicing process, you will need to have information on sales and purchase orders on the invoicing system

Accounts Receivable Management

Once the invoice is generated and sent to your customers, the job of your accounts receivable (AR) team starts to ensure the payment is collected. In this exercise, financial management software will be useful for automating the accounts receivable process. It will also automate other processes, such as flagging overdue accounts and generating regular reports. To understand it more, check the guide on accounts receivable.

Payment Collection

It’s a fact that many customers do not pay on time, and it’s the job of your accounts receivable team to take necessary action to collect the payments when required. A customer who is habitual in delaying payments must be flagged and prevented from making further purchases.

However, missed payments can also happen due to incorrect billing addresses, forgetful customers, or outdated payment information. Only an effective collection process can balance between customer relationships and collecting timely payments.

Reporting & Analysis

Using software, you can analyze the efficiency of your order-to-cash process and identify areas for improvement. If using software is not an option, then you can partner with an accounting firm that offers order-to-cash services, including the use of software for reporting and analysis.

For Example:

Imagine a long standing customer places a big order after weeks of back & forth discussions & approvals. As soon as the order gets confirmed, all the agreed on details like pricing, credit terms & delivery dates just get loaded into the system – no emails, no more unnecessary phone calls. Operations pick up the order, the finance team clears the credit, and boom – the warehouse is already prepping the shipment on time. Once everything is delivered out the door, the invoice goes out automatically, and the finance team can keep track of payments without needing to chase anyone up or do any guessing. As a result, the cash rolls in as expected, the leadership team has a clear view of what’s going on, and the customer just leaves feeling confident that the business is running like a well-oiled machine in the background.

Common Challenges in the Order to Cash Process

Is your order-to-cash process plagued by challenges? We understand it is hard to fix it, but it’s worth a shot. Some of these common challenges that can be fixed are:

Time-consuming Manual Processing

Processing orders, invoice generation, and reconciling payments can bog down your staff and invite human errors. Only automation through software can complete these tasks quickly, reducing processing time and increasing accuracy. This way, you save time, which can be used for managing customer relationships or pursuing new leads.

Incorrect Pricing Information

When product pricing is not consistent across the system, it creates problems like incorrect invoices, payment delays, and customer frustration. Centralized software tools will allow you to update the pricing automatically across every department.

Delays in Order Processing and Shipment

Slow processing of orders and shipments can frustrate your customers and damage the reputation of your business. By incorporating real-time order tracking and automated notifications, you can reduce compliance issues by keeping your customers informed even if there are any delays.

Lack of Compliance

Lack of required documentation and order inconsistencies will put you at odds with US regulators like IRS and state regulators. Non-compliance will lead to penalties, fines, legal action, reputational damage, or license revocation. Therefore, it is necessary for you to devise a standardized order-to-cash process and maintain digital records to reduce risks and provide an audit trail for compliance when needed.

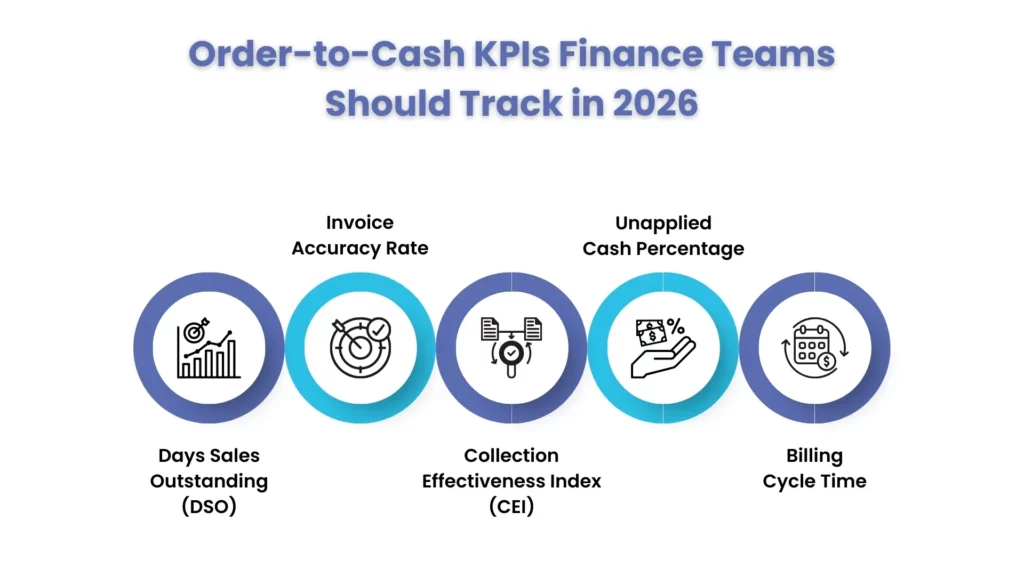

Order-to-Cash KPIs Finance Teams Should Track in 2026

If you cannot measure it, how can you fix it? That makes these KPIs important and turns you from reactive to proactive.

- Days Sales Outstanding (DSO): It measures how long it takes to collect after a sale.

- Invoice Accuracy Rate: Here, the billing mistakes are measured, and it’s important. After all, billing mistakes equal delayed payments.

- Collection Effectiveness Index (CEI): This KPI shows how effective collections are compared to total receivables.

- Unapplied Cash Percentage: If this is high, your process is costing you time and customer trust.

- Billing Cycle Time: It measures how fast you invoice after delivery. The quicker the billing, the faster the cash payment or recovery.

How Finance Teams Optimize Order-to-Cash Using Automation

Want to stay on top of order-to-cash? Say goodbye to spreadsheets and reminders.

Automation helps by:

- Generating invoices instantly post-delivery

- Matching purchase orders automatically

- Sending reminders based on payment behavior

- Applying cash with smarter matching rules

- Flagging at-risk accounts before invoices go overdue

Finance automation is also becoming essential due to increasing compliance expectations around:

- Controls

- Audit trails

- Role-based approvals

- Clean revenue reporting

Order to Cash Services for Best Practices

Enough of knowing the order-to-cash process. Now, let’s focus on how to speed up the process by incorporating some best practices.

Check Each Step in the Process

Get a deep understanding of each step in the order-to-cash process. For example, when an order is placed, what will trigger the fulfillment process automatically, and when it needs manual intervention. How will payments be collected? And so on. These checks will help in further streamlining and automating the process.

Start With the Low-Hanging Fruit

Target the problem that requires the least effort and offers maximum return. Such common problems include fulfillment delays, high shipping costs, and late customer payments.

Promote Automation

Automating the order-to-cash process using software will boost your cash flow and operating efficiency while improving your customers’ experience. For example, software will automate invoice generation and reconciliation, payment reminders, and reminders of delayed payments to receive. Such automation will reduce errors in billing and order fulfillment by reducing duplication or errors in data entry.

Exploring Partnering with Accounting Firms

Running the order-to-cash process requires handling multiple software applications for each function. However, it can be avoided by availing the order-to-cash services of an accounting practice. A professional accounting practice assists in building a unified database, helping your business accelerate and automate the entire process.

Through professional accounting services, you will also get access to advanced dashboards and reporting capabilities that help businesses monitor trends, quickly identify problems, and analyze process efficiency. Select the right accounting partner to avail the maximum benefit.

Pay Attention to Insights Provided by Your Customers and Staff

Insights provided by your staff and customers are valuable because they show the strengths and weaknesses of your order-to-cash process. If your customers are frequently complaining about shipping delays or billing errors, then it’s time to prioritize and fix them.

The Future of the Order-to-Cash Process in 2026 and Beyond

So, this is what the future of the order-to-cash process will look like in 2026.

- AI-supported collections prioritization

- Automated dispute handling

- Predictive cash forecasting

Businesses that incorporate the above points in the order-to-cash process will enjoy:

- Better cash control

- Lower borrowing needs

- Higher customer satisfaction

- Stronger scalability

People Also Ask:

What is billing in Order to cash?

It means asking the customer to pay for the purchases made from you, usually after issuing the invoice.

What are the benefits of an effective order-to-cash process?

One of the major benefits of an effective order-to-cash process is the smooth flow of cash.

How does shipping and delivery impact the overall O2C cycle?

Any delays in shipping products to your customers will create invoice disputes and slow down the payments.

What role does credit management play in the Order-to-Cash process?

It’s a crucial step in the process that helps in minimizing losses by creating appropriate credit limits based on the customer’s payment history as well as current financial and market conditions.

What is the difference between P2P and O2C processes?

In order-to-cash, the customer is making an order, whereas in procure-to-pay, the business is making an order.

Conclusion

When you are continuously chasing payments from your customers, then it’s time to acknowledge that something is wrong, not in your business but in your order-to-cash process. In 2026, only those businesses will be winners who can collect the payments, forecast, and have good financial controls.

Achieving that single-handedly for a business can be tricky; many of your counterparts have resorted to partnering with accounting firms to handle this process. One of them is Corient, the rising star, which has helped many businesses in streamlining their order-to-cash process from start to end. Our well-designed order-to-cash services along with record to report services and procure to Pay services will cover everything so that you can solely focus on business expansion.

Are you fed up chasing your customers for payments? It’s time to partner with us, use our contact form, and build a system where payment arrives on time without additional stress.

Talk to us today