The global energy landscape is constantly undergoing a seismic shift. It is all about how our world has been evolving, right from the traditional rigs of the oil and gas industries to the massive wind farms with the help of the renewable sectors. Nevertheless, the truth is also that behind each kilowatt-hour of production, and each barrel of refined oil, lies the complex web of financial data.

Accounting for energy companies is not just about balancing books but also navigating through a volatile market where the prices of commodities change every second, following regulations is a major challenge, and the investments in capital are in billions. In such an environment, financial accuracy is the difference between a sound and sustainable future and a fiscal crisis. This blog explores the complexity of energy accounting, challenges that professionals encounter, and how to make financial management a competitive advantage.

What Is Accounting for Energy Companies?

Accounting for energy companies is defined as the accountancy that is specialized in energy-related businesses such as the production, manufacturing, distribution, and selling of energy. This covers oil and gas companies, renewable energy start-ups (solar, wind and hydro), and state utilities.

This is unlike a normal retail or service company, accounting for energy companies is considered as a long-term depletion of the natural resource, mega infrastructure depreciation and complicated environmental liabilities. It is a sector characterized by a high level of capital intensity and project lifecycle, whereby one investment can take ten years to realise profit.

Why Accounting Is Critical in the Energy Sector?

In the energy sector, the stakes are exceptionally high. Precision in accounting is critical because:

- Capital Allocation: Energy projects demand huge initial capital. Proper accounting will help in the deployment of capital in the most efficient way and also track ROI in a realistic manner.

- Risk Management: Due to fluctuating commodity prices, businesses should have real-time financial accessibility, which will allow them to hedge against market fluctuations.

- Stakeholder Trust: Investors and lenders demand transparent reporting to justify the high-risk nature of energy ventures.

Key Challenges in Accounting for Energy Companies

Navigating the accounting for energy companies requires more than just standard bookkeeping. Here is a deep dive into the most pressing obstacles:

1.Estimating Asset Retirement Obligations (ARO)

The Critical Hurdle: Is it the legal responsibility of the energy companies to “clean up” after themselves, be it plugging an old oil well or decommissioning a giant wind turbine. Estimating these costs, which might occur 30 years from now, is incredibly difficult.

The Bottom-Line Impact: If your ARO estimates are too low, you are essentially carrying a “hidden debt” that will eventually devastate your cash flow and mislead investors about the company’s long-term health.

Recommended Strategy: While accounting for energy companies, consider conducting annual reviews of decommissioning costs. Don’t just adjust for inflation; adjust for new environmental regulations and changes in labor and technology costs.

Audit Red Flag: Auditors will scrutinise the “discount rate” and “settlement dates” you use. If your assumptions seem overly optimistic compared to industry benchmarks, expect a long list of follow-up questions.

2.Managing Commodity Price Volatility

- The Critical Hurdle: Unlike a tech company with a fixed subscription price, an energy company’s “product” value changes by the minute. This makes it difficult to value ending inventory and forecast future revenue.

- The Bottom-Line Impact: Drastic falls in market prices can cause the so-called impairments, reducing the value of your assets on the balance sheet by giant amounts, causing colossal paper losses which can terrify lenders.

- Recommended Strategy: Introduce effective hedge accounting. Lock in prices using derivative instruments, but make sure they are carefully documented in order to be treated in accounting favorably while accounting for energy companies.

- Audit Red Flag: Auditors will seek to find an assessment of the Lower of Cost or Net Realisable Value (LCNRV). If the market price dropped below your production cost and you didn’t write down the inventory, you’re in for a rough audit.

3.Complexity of Joint Interest Billings (JIB)

- The Critical Hurdle: Most large-scale energy projects are joint ventures. One company (the operator) spends the money and then bills the other partners for their share. This creates a mountain of transactional data.

- The Bottom-Line Impact: Errors in JIB lead to “disputed billings,” which strain partner relationships and can result in significant cash flow delays or even legal battles over unpaid expenses.

- Recommended Strategy: Standardize your Chart of Accounts with your partners early in the project. Use automated energy-accounting software that can split costs at the line-item level automatically.

- Audit Red Flag: The “Joint Interest Audit” is a common industry practice. Auditors will look for evidence that overhead costs were allocated fairly and according to the specific Operating Agreement (JOA) signed by the partners.

Real-World Accounting Scenarios in Energy Companies

To understand the complexity of accounting for energy companies, let’s look at two common scenarios:

- The “Dry Hole” Scenario: In oil and gas exploration, a company might spend millions drilling a well that turns out to be empty. Under “Successful Efforts” accounting, that cost is expensed immediately. Under “Full Cost” accounting, it might be capitalised. The choice of method drastically changes the company’s reported profit.

- Renewable Energy Power Purchase Agreements (PPAs): A solar farm signs a 20-year deal to sell power at a fixed price. Accountants must determine if this contract contains a “lease” component under Ind AS 116, which changes how the revenue and assets appear on the balance sheet.

Regulatory Framework and Compliance in Energy Accounting

Compliance is perhaps the most daunting aspect of the industry. The sector is governed by a patchwork of international and local standards:

Accounting Standards (Ind AS/IFRS)

The mention of Ind AS alongside IFRS is a clear nod to how India’s accounting standards line up with the rest of the world. For instance, Indian energy companies follow Ind AS 116 when it comes to lease accounting – not a surprising move considering it’s basically the same rules as IFRS 16. This one’s a big deal for companies that are laboring to meet their financial reporting requirements under Ind AS.

Regulatory Commission Guidelines

When we’re talking about regulatory body guidelines, in India, the Central Electricity Regulatory Commission (CERC) plays a huge role in keeping an eye on energy prices and operational rules. Energy companies need to make sure they’re following the book, just like their international counterparts do with their own regulators.

Environmental, Social, and Governance (ESG) Reporting – i.e., Sustainability Reporting

There’s a lot of movement in India around ESG reporting, especially for publicly traded companies. As you’d expect, the SEBI’s Business Responsibility and Sustainability Report (BRSR) requires businesses to put their ESG credentials on the table – so to speak – including carbon emissions and all that jazz ( i.e. various financial and climate change risks), making this one highly relevant for Indian energy companies.

Taxation

And then there’s GST – or the goods and services tax for those who don’t get straight away. In short, it’s a big deal for Indian energy companies that need to navigate indirect taxes on services and goods in the sector.

Common Accounting Mistakes Energy Companies Should Avoid

Even the most experienced finance teams can stumble when faced with the granular demands of the energy sector. Below are a few common mistakes that one should avoid while accounting for energy companies.

1.Misclassifying Exploration vs. Development Costs

- The Critical Hurdle: There is a fine line between “looking for resources” (exploration) and “preparing for production” (development).

- The Bottom-Line Impact: Misclassification leads to incorrect capitalisation. If you capitalise a “dry hole” instead of expensing it, your balance sheet becomes artificially inflated.

- Recommended Strategy: While accounting for energy companies, establish a rigorous “Phase Gate” process. Costs should only move to a capital asset category once “Proved Reserves” have been officially confirmed.

- Audit Red Flag: Auditors will pull your “Well Files.” If they see capital being spent on a project that hasn’t cleared the feasibility stage, they will challenge your asset valuations.

2.Overlooking the “Time Value” in Asset Retirement Obligations (ARO)

The Critical Hurdle: Companies often record the initial cost of site restoration but fail to “accrete” the liability over time.

The Bottom-Line Impact: This results in a “stealth liability.” As the project nears its end, the company realises it hasn’t set aside enough capital for the cleanup.

Recommended Strategy: While accounting for energy companies, use an automated accretion schedule to gradually increase the liability on the balance sheet so that it matches the expected future cost.

Audit Red Flag: Auditors will check your “Accretion Expense” calculations. If the liability has stayed the same for years, it’s a sign of a major oversight.

Avoiding these mistakes requires more than process fixes—it requires the right technology. The Top 5 Energy Accounting Software Packages in the Energy Industry outlines platforms designed for complex energy accounting needs.

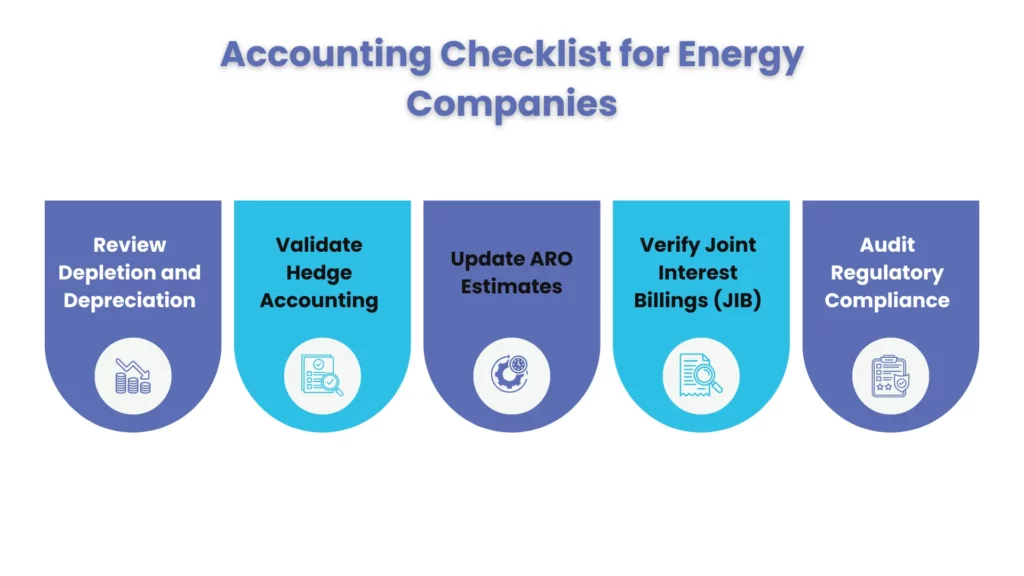

Accounting Checklist for Energy Companies

To maintain financial health, energy firms should follow this essential checklist:

- [ ] Review Depletion and Depreciation: Are the units-of-production rates updated based on the latest reserve reports?

- [ ] Validate Hedge Accounting: Are derivative contracts properly documented and their effectiveness tested?

- [ ] Update ARO Estimates: Have inflation or technology changes affected the estimated cost of site restoration?

- [ ] Verify Joint Interest Billings (JIB): Are partners being billed accurately for their share of operational expenses?

- [ ] Audit Regulatory Compliance: Are all filings for FERC, SEC, or local energy boards up to date?

The Importance of Industry-Specific Financial Reporting

Generic financial software often fails in the energy world. Financial reporting for this sector requires extreme granularity. It isn’t enough to see “Operating Expenses”; management needs to see “Lease Operating Expenses (LOE)” per barrel of oil equivalent (BOE) or per Megawatt-hour (MWh).

Industry-specific reporting allows companies to perform “Lifting Cost” analysis by identifying exactly how much it costs to bring energy to market. This level of detail is essential for deciding when to shut down an underperforming asset or where to invest in new technology.

People Also Ask

What makes accounting for energy companies different from other industries?

The primary differences are the high capital intensity, the use of specialised methods like “Full Cost” or “Successful Efforts” for exploration, and the requirement to account for “Asset Retirement Obligations” makes accounting for energy companies different from other industries.

Where are utility expenses recorded in financial statements?

It involves setting up a Chart of Accounts that tracks costs by well, mine, or farm. It involves recording Depletion and strictness in joint venture partners in joint interest billing.

What are the biggest accounting challenges faced by energy companies?

The most prominent challenges are the inability to deal with the volatility of commodity prices, the right pricing of long-term assets, adhering to the changing environmental regulations (ESG), and the JIB management.

Which accounting account category is used for utility expenses?

Utility expenses fall under Operating Expenses in a normal chart of accounts. These costs, however, when it comes to a utility provider, are included under the Cost of Sales section as Production or Distribution Costs.

Turn Accounting into a Strategic Advantage with Corient

The complexities of energy accounting shouldn’t hold your business back. Navigating the transition from fossil fuels to renewables while maintaining strict compliance requires a strategic partner.

Corient provides specialised finance and accounting services designed specifically for the energy sector. Our team understands the nuances of joint venture auditing, regulatory compliance, and complex tax structures. By outsourcing your financial functions to Corient, you gain access to:

- Scalable accounting teams that grow with your projects.

- Advanced technology stacks for real-time reporting.

- Expertise in both traditional and renewable energy financial frameworks.

Don’t let your back office be a bottleneck. Let Corient transform your accounting from a compliance burden into a strategic asset that fuels your growth.