Have you signed up to spend the majority of your time making sure bill payments are on time while starting your business? Certainly not. Still, for many US businesses, accounts payable has quietly become a daily source of friction.

It would be unfair to confine accounts payable to just paying bills. If carefully done, it can become a perfect tool for cash flow discipline, control, and credibility. When done poorly, it creates late fees, audit headaches, strained vendors, and inaccurate financial reporting. A streamlined accounts payable process enables visibility into your business’s financial well-being and can unlock insights that help you grow.

In this blog, we will go through the basics of accounts payable and break it down. This blog has a few surprises along the way.

What Is Accounts Payable?

Accounts payable can be termed as a business expense. These are bills that your business owes to your suppliers for the goods and services supplied to you. In simple terms, if you’ve received the invoice but haven’t paid it yet, that’s accounts payable.

What are Key Components of Accounts Payable?

Accounts payable is what it is because of several key components. Therefore, to understand accounts payable, you will need to understand its key components. Let’s break down these components for you:

1.Vendor invoices

Almost all businesses purchase goods and services from their suppliers on credit. These invoices are the backbone of accounts payable. These invoices for office supplies and raw materials must be recorded and paid on time to maintain a good vendor relationship.

2.Operating Expenses

Utility bills such as electricity, water, and internet services come under accounts payables. These expenses might look routine, but missing these payments can seriously impact your business operations. For example, a delay in payment of dues to your internet service provider means loss of internet connection and productivity.

3.Employee Reimbursements

Expenses related to business travel, meals, and office supplies are incurred by your employees on behalf of your business. These reimbursements come under accounts payable and are vital for keeping your employees satisfied.

4.Accruals and bills payable

Accruals refer to expenses that have been incurred but not yet paid. This includes wages, interest, and tax obligations that will eventually need to be settled. Properly managing these through accounts payable ensures your company has a clear picture of its financial liabilities.

What are Examples of Accounts Payable?

Here are common, everyday examples of AP:

- Office rent and utilities

- Inventory purchases

- Software subscriptions

- Professional services (legal, accounting, consulting)

- Logistics and shipping costs

If your business operates on credit terms, accounts payable is unavoidable and powerful.

What Tasks Are the Include in Accounts Payable?

Your accounts payable team is handling a lot more than ensuring payments. Their responsibilities are quite wide and elaborate, which include:

- Receiving and validating invoices

- Conducting 2-way or 3-way matching of invoices to POs and receipts

- Handling approvals and exceptions

- Scheduling payments strategically

- Maintaining vendor records

- Reconciling accounts payable balances

- Supporting audits and compliance

Inaccuracies in accounts payable will just delay the entire payment process, thus distorting your financial reporting.

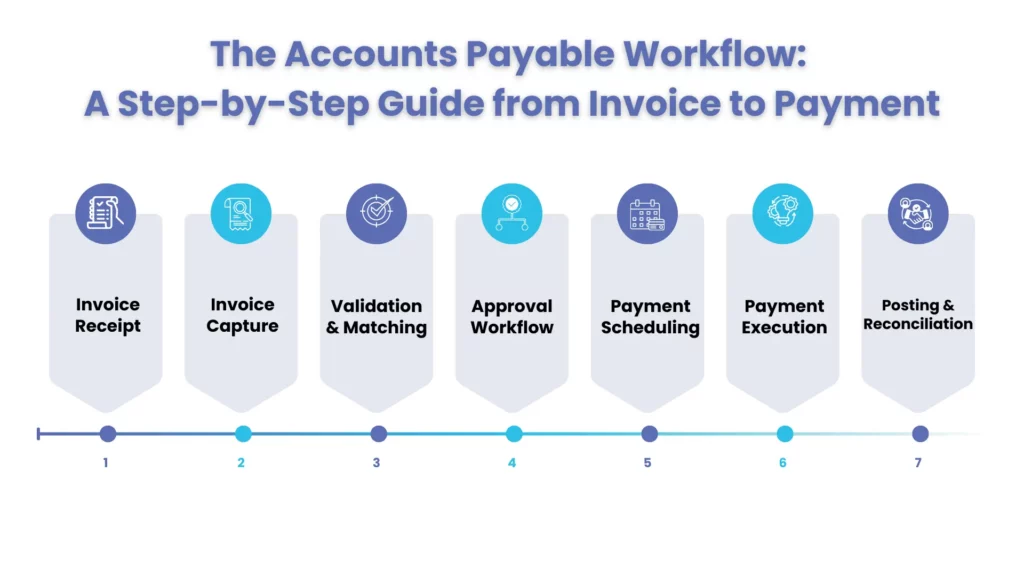

The Accounts Payable Workflow: A Step-by-Step Guide from Invoice to Payment

At first look, accounts payable seems like a simple payment function, but in reality, it is a multi-step control system that determines the pace of cash outflow. A well-designed accounts payable workflow will make payments on time, without errors, and strengthen your relationship with the vendors.

Here’s how it will operate:

1.Invoice Receipt

The process begins with the arrival of an invoice via email, paper or through a vendor portal. In this stage, invoices are logged and time-stamped. Any delays in this will trigger late payments, which is why many businesses have centralized the invoice receipt to avoid missing or duplication of bills.

2.Invoice Capture

All the details in the invoice must be captured, which includes vendor name, invoice number, dates, line items, amounts, and tax. When it was manual, all these details needed to be typed. However, with digitization, these data can be extracted automatically, reducing errors and speeding up the process.

3.Validation & Matching

The legitimacy of the invoices must be ensured through proper validation and matching. These invoices are matched against purchase orders and receiving documents multiple times. Such validation protects the business from duplication, overbilling, and fraud, which are the biggest risks in accounts payable.

4.Approval Workflow

Once you are done with the validation, the invoices are forwarded to the right approvers based on amount, department, or vendor. This step has been automated, thus overcoming significant bottlenecks, maintaining compliance, and creating an audit trail. Without clear approvals, payment cannot be made.

5.Payment Scheduling

When invoices are approved, the schedule for payment is fixed. Here’s where you will need to be extra careful: paying too early might strain your budget, and paying too late will damage the trust of your supplier. Balance it out accordingly.

6.Payment Execution

Payments can be executed using checks, Automated Clearing House, or wire transfers. Recently, it has been noticed that many of your counterparts are moving from check to electronic payments to reduce the risk of fraud, processing costs, and reconciliation time.

7.Posting & Reconciliation

Once the payment is successfully made, the transaction is recorded in the general ledger. Accurate posting leads to reliable financial statements and supports the record-to-report process. For further assistance in optimizing your record-to-report process check here.

It must be noted that accounts payable workflow has a direct impact on the procure-to-pay process. Any breakdown in the workflow will have a ripple effect, such as late fees, cash shortages, reporting errors, and audit issues. For further assistance check our procure to pay services.

Accounts Payable and Receivable Management

| Accounts Payable | Accounts Receivable |

| Money you owe vendors | Money customers owe you |

| Current liability | Current asset |

| Cash outflow | Cash inflow |

| Impacts DPO | Impacts DSO |

| Vendor-focused | Customer-focused |

Both accounts payable and accounts receivable work in synch towards your cash conversion cycle. Paying too fast will strain your budget, and paying too slow will damage your relationship with your vendor. Therefore, maintaining balance is important.

Want to understand the other side of cash flow? Check out our blog : How Accounts Receivable works

How to Calculate Accounts Payable

Accounts payable include every outstanding expense your business owes while purchasing goods and services, except payroll expenses. These expenses are not paid instantly, therefore they are considered liabilities in your accounting records.

To measure your AP, you will need to use the AP turnover ratio. It measures how many times your business pays its creditors over an accounting period. To do that, you divide net credit purchases by average accounts payable.

A simple AP balance formula: Accounts Payable = Total Vendor Invoices Outstanding

Let’s understand it better using an example: Company X wants to calculate their AP turnover ratio for the past year. At the beginning of the period, the AP balance was $700,000, and the ending balance was $784,000. Purchases for the last 12 months were $6,500,000. As such, the AP turnover is calculated as:

$6,500,000 in purchases ÷ (($700,000 in beginning payables + $784,000 in ending payables) / 2)

Which equates to:

$6,500,000 in purchases ÷ 742,000 in average accounts payable = 8.8 AP turnover ratio

So, the company’s AP turned over 8.8 times during the past year.

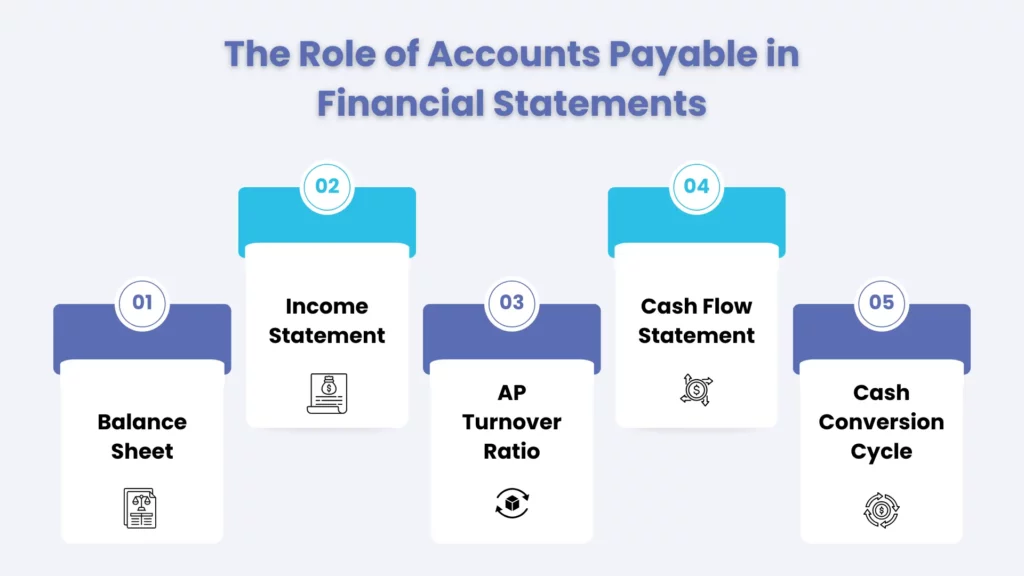

The Role of Accounts Payable in Financial Statements

Accounts payable play a significant role in financial statements and have an impact on a company’s financial position.

Let’s understand what role it plays in the financial statements.

Balance Sheet

Accounts payable in the balance sheet offer valuable information to your stakeholders about your liquidity and ability to meet short-term obligations. It also helps in evaluating your working capital management and supplier relationships.

For Example,

Let’s say a company’s got the following numbers:

- Current assets of $400,000

- Accounts payable of $120,000

This tells us right away that $120,000 of cash or near-term resources will be needed to pay off that supplier tab. And if AP starts growing faster than those current assets over time? It might be a sign that the business is having some liquidity issues or is relying a bit too heavily on supplier credit. On the flip side, if AP stays steady? That’s a good sign the company’s got a handle on working capital and supplier relationships.

Income Statement

Accounts payable also influence the calculation of critical financial ratios that assess a company’s operational efficiency and profitability. For instance, the AP turnover ratio measures how efficiently a company manages its accounts payables by calculating the number of times it pays its suppliers in a given period.

You won’t find Accounts Payable on the income statement itself, but it does play a role in how expenses get recorded and how that affects profitability under accrual accounting.

For Example:

Imagine a company buys $50,000 worth of inventory in March but doesn’t pay the supplier until April. That expense still gets recorded in March – which is a good thing, because it lets us get an accurate picture of costs for the period. If AP wasn’t recorded correctly, that expense might get swept under the rug or something and we’d get a totally misleading picture of profitability.

AP Turnover Ratio

Stakeholders often look at the AP Turnover Ratio to get a sense of how well a company does with managing AP. That ratio gives you an idea of just how often suppliers are getting paid during the year.

Formula:

AP Turnover = Net Credit Purchases ÷ Average Accounts Payable

- Annual credit purchases: $900,000\

- Beginning AP: $140,000\

- Ending AP: $100,000\

- Average AP: $120,000

AP Turnover = $900,000 ÷ $120,000 = 7.5 times per year

A higher ratio says the company is keeping on top of payments to suppliers and keeping cash in check, while a lower ratio might indicate some cash flow issues or – you guessed it – delayed payments.

Cash Flow Statement

A cash flow statement shows your ability to generate cash from your business operations. Changes in accounts payable will impact the cash flow, and understanding it will help your investors in making informed decisions.

When AP goes up or down it affects cash flow from operating activities.

For Example

If AP jumps from $90,000 to $120,000 during the year that means the business is carrying over some supplier payments and holding onto that cash a bit longer. That results in higher cash flow for the period even though no actual cash has changed hands.

Investors are always keeping an eye on these numbers – mainly because it helps them figure out whether any improvements in cash flow are due to actual operational performance or just some fancy payment timing.

Cash Conversion Cycle

The cash conversion cycle measures the time it takes for a company to convert its investments in inventory and accounts payable into cash inflows from sales. Accounts payable represent the average payment period and are crucial in shortening the cash conversion cycle.

Formula:

Cash Conversion Cycle = Days Inventory Outstanding + Days Sales Outstanding – Days Payable Outstanding

For Example

- Inventory is tied up for 60 days

- Customers take 40 days to pay their bills

- Suppliers are paid in 45 days

CCC = 60 + 40 – 45 = 55 days

So that means it takes 55 days for the company to get its cash back from the suppliers. If the company can somehow manage to get its suppliers to give it a bit more time to pay, that can actually help its cash position out quite a bit.

Accounts Payable Automation Solutions

There was a time when accounts payable used to be manual and it was very expensive. Studies show that without automation, accounting teams spend 40 to 60% of their time only on transaction processing. However, with the introduction of automation, things have become better.

Electronic accounts payable solutions help by:

- Capturing invoices automatically

- Enforcing approval rules

- Reducing duplicate payments

- Improving audit trails

- Speeding up close cycles

Automation also supports compliance expectations under:

- GAAP

- IRS documentation standards

- Internal controls aligned with SOX-style governance

Naturally, investing in tools to automate the AP process is a task. But by partnering with accounting firms offering finance and accounting services, you can get access to automation tools at a reasonable cost.

See how a modern accounting firm helped streamline Accounts Payable, Tax, and Commissions with automation and strong controls.Download the Case Study

Common Challenges in Account Payable

While managing accounts payables, you will come across significant challenges that can slow down your business operations. Complexities in ensuring timely payments, maintaining accuracy, and keeping up with regulations are turning accounts payable into a time-consuming process.

Let’s understand some of those common challenges:

1.Manual Processes and Data Entry Errors

There are still some businesses relying on manually handling invoice processing. These are time-consuming tasks and often prone to human errors. Imagine a situation where you will have to handle thousands of invoices by hand, it’s next to impossible not commit an error. These errors can lead to delays in payment and damage your relations with your vendors.

2.Late Payments and Missed Deadlines

Making payments to your vendors on time is one of the key functions of accounts payable. However, keeping track of deadlines for multiple invoices is a difficult task if handled manually. Missing deadlines will lead to late fees, strained vendor relationships, and potential cash flow issues.

3.Dealing with Inconsistencies

When invoices do not match the purchase order, it leads to disputes with your suppliers, causing delays in payments and significant effort to resolve them.

4.Regulatory Compliance

Maintaining compliance with evolving US federal (IRS, SEC) and state regulations is a tough job without automation. Failure in compliance will invite hefty fines from the regulators and damage your reputation.

The only way to overcome the above-listed challenges is through the automation of AP. Through automation of accounts payables, you can achieve:

- AI-based invoice matching

- Handling of workflows

- Real-time dashboards

- Secure, traceable approvals

Conclusion

Accounts payable, when operated smartly, can give greater benefits such as enforcing trust with your vendors, streamlining cash flows, improving financial reporting, and supporting your record-to-report process.

One way of operating smartly is by not doing accounts payable in-house, but from outside by partnering with an experienced accounting firm like Corient. We have gathered considerable experience in handling and modernizing accounts payables through our scalable finance and accounting services using expertise, automation, and perfect controls.

Are you struggling with accounts payables-related issues? Connect with us and check our services, and turn accounts payable to your advantage.