Introduction

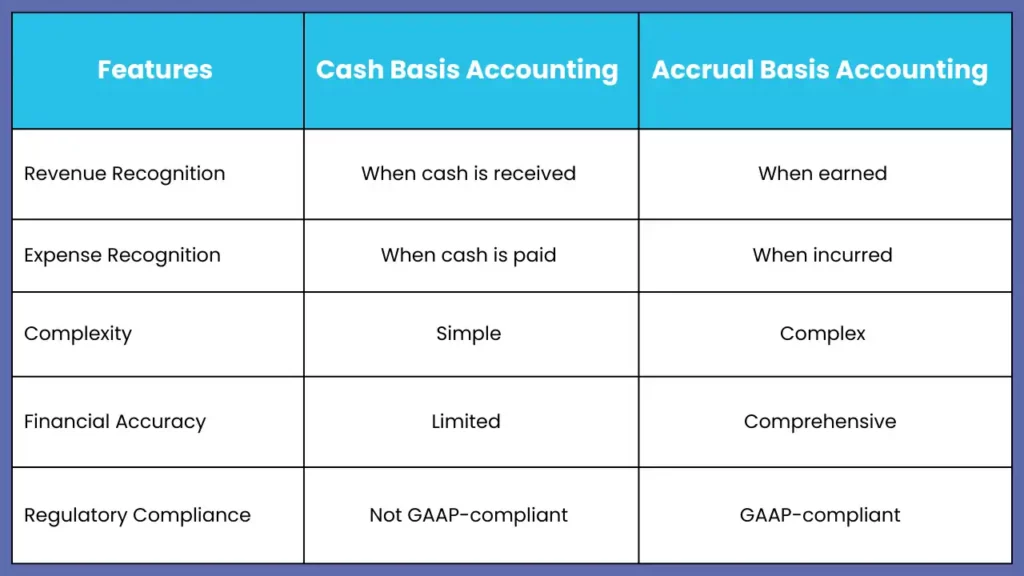

The two primary types of accounting methods used by majority of the companies around the world are – Cash Basis Accounting and Accrual Basis Accounting. These methods of recognizing expenses and revenue helps in the accurate preparation of financial statements, that eventually helps in effective decision-making.

Whether you are a large cooperation, or a growing solo entrepreneur, one must know these primary methods of revenue/expense recognition, if you want to grow and expand while complying with rules and regulations.

In this blog, we will explore as to what is cash-basis accounting and accrual basis accounting, difference between accrual vs cash basis accounting, and how to determine which method suits your business. We will also understand why many are opting to partner with Corient Business Solutions and what sets us apart in the accounting Services.

What is Cash Basis Accounting?

The revenue and the expenditures are recognized only when the cash is exchanged. Think of it as a tangible result that you can see and feel. When you get cash in hand, then only can you categorize it into revenue. Likewise, if you spend money, and literally your money goes out of the bank to others, then only the expenditures are recognized.

It is a simple accounting method, where cash-flow is easily tracked and there’s no mention of liabilities, outstanding expenses, account receivables and payables within the financial statements.

This method is popular among small businesses and sole proprietors due to its simplicity and key features.

- Cash is everything – Revenue is recorded when cash is received, and expense is recorded when cash is exchanged

- The income statement will show lower income, compared to Accrual Method, for a fiscal year.

- No accounts receivable or payable are tracked.

Examples of Cash Basis Accounting Method

You are an aspiring graphic designer freelancer. You got your first client on January 15th, and have sent him an invoice for the completion of 10 posts within 10 days. The invoice also outline that the client must pay the amount on January 25. For some reason, the client was not able to pay you by 25th, instead it got dragged to February 2. Under cash basis accounting, the income is recorded on February 2nd and not on January 25th.

Benefits of Cash Basis Accounting Practice

- It is easy to understand and implement. Any transaction is recorded, only when cash is exchanged – nothing more, nothing less.

- This provides you with a clear view of cash-flow and availability. Activities that have led to generation of income – can be easily tracked and further optimized.

- It is a cost-effective method that requires minimal bookkeeping because it only tacks cash transactions. It doesn’t require detailed ledger formation based on each party involved.

Limitations of Cash Basis Accounting

- When you only track cash – going in or out, it can give you a false idea that your business is performing well. If you are a season-based business that performs really well on specific occasion, then believing that your financial health is good, might be an overstatement – as it does not compute to the company’s overall performance over a period, rather- as of a specific moment.

- If you are a small local business in the US, then using cash basis accounting method will not comply with US. GAAP standard, unless and until your business meets certain criteria (such as being a small business and meeting a revenue threshold)

- Cash basis accounting method is not applicable to businesses that offers credit. Even if you sell an item on credit, revenue will not be recorded until the cash is received. If the client doesn’t pay you, then not only the inventory decreases, but you also can’t subtract it as a loss because no expense is recorded until the payment is made.

What is Accrual Basis Accounting?

Opposite to the cash-based accounting, accrual method recognizes the income and expenditure when they are earned or incurred, regardless of the cash flow. In simple terms – an expense or income is recognized when a product or service- is delivered. It could be on credit basis, where payment is to be made in the near future. The key features of Accrual basis accounting are-

- It tracks accounts receivable and payable.

- When goods or services are exchanged, then the revenue is recorded, and not when cash is received.

- Expense is recorded when incurred, and not when cash is paid.

Examples of Accrual Basis Accounting Practices

A client has pre-booked a hotel 1 month before their travel on April 1st 2024. Now for the financial year 2024 – will the revenue be recognized by the hotel?

No. Under Accrual method of accounting, since the service has not been utilized yet, the revenue for the fiscal year 2024 will not be recorded.

Let us understand with one more example – A heavy manufacturing company has delivered the goods to a client on December 20. The client has made payment on June 20 of the next year. Under accrual accounting – revenue will be recognized on December 20 of the same year, and not when cash is received.

Benefits of Accrual Accounting

- It allows trade payable and receivable to come into picture.

- Firms that practice Accrual method attracts investors as they get true picture of the firm’s financial performance.

- Ensures effective decision-making through accurate budgeting and forecasting.

Limitations of Accrual Accounting

- It is complex, hence requires sufficient, advanced knowledge and time to accurately record it into the book of business.

- Since it is time-consuming, the cost also increases – as resource and workforce allocation, investment in updated technology costs more.

- Though the financial health of the company is healthy, the cash-flow is tight, presenting problems in immediate liquidity needs.

Key Differences Between Accrual and Cash Basis Accounting

The debate of Accrual vs Cash Basis Accounting often boils down to revenue recognition, expense recognition, complexity, and compliance.

Why Do Companies Follow Accrual Accounting?

Companies aiming to reach global standards and financial accuracy, go for accrual accounting. It complies with GAAP and IFRS Standards, offering precise understanding of profitability and financial health. It is one of the leading accounting methods, making use of both the matching principle and revenue recognition principle, where the revenue is realized when earned or when performing an action (regardless of the cash coming-in), and matching expense incurred – all within the same period.

Companies gain financial clarity and induce in strategic long-term planning with proper resource allocation and budget to meet each year’s KPI’s. The method builds trust in stakeholders by presenting accurate financial data – with the ability to handle more complex high-volume transactions and operations, as they grow.

How to Decide the Right Method for Your Business?

Choosing between Accrual vs Cash basis accounting for your business, depends on number of factors:

- Business Size and Complexity: Small businesses may benefit from cash basis accounting, whereas larger enterprises can benefit from accrual accounting, taking into consideration outstanding expenses, liabilities, payables, which provides a more accurate financial picture that in turn contributes to building investors trust.

- Regulatory Requirement: Businesses needing audited statements must use accrual accounting.

- Long-Term Financial Goal: When the business grows – both vertically and horizontally, complexities in expenses and revenue recognition becomes visible. At times, you have to give the product/service on credit to suppliers and vendors to gain trust and establish a healthy work relationship. With Accrual method, you can get an accurate financial overview of the recorded revenue and expenses when incurred. This aids in long-term decision-making and enhances trust with stakeholders.

If you want to switch from cash to accrual accounting, consult processionals like Corient to ensure the transition is smooth, adhering to all regulatory compliances and policies.

Why Choose Corient Business Solutions?

Partnering with Corient can help you determine the right choice in Accrual vs Cash Basis Accounting and ensure seamless implementation.

Our Expertise

- Proven track record in accounting and bookkeeping

- Proven experience in the transition process – from cash to accrual as the business grows

- Skilled in implementing both cash and accrual accounting methods.

- Providing customizable tailored solutions for each business, based on the size and goals of the firm.

Benefits of Partnering with Corient

- Streamlined Processes: Save time and resources with professional support.

- Enhanced Accuracy: Ensure compliance and financial clarity.

- Growth-Oriented Solutions: Receive insights to scale your business effectively.

Look into our testimonials and case studies to gain assurance on Corient’s capability and expertise.

Conclusion

Accrual vs Cash basis accounting are two major accounting methods, recognized by IFRS and US. GAAP. While cash basis accounting is simple, and suitable for small businesses, any company looking to expand and reach global standards should follow accrual accounting method.

Contact Corient Business Solutions to identify the best suitable accounting method for your business. We are only a click away and ready to assist you. Utilize our decades of experience and expertise to elevate your financial management to the next level. Now the next time you have a doubt – of key differences between accrual vs cash basis accounting, you will know exactly what it is. If more doubt persist, contact our skilled team to get your one-to-one consultation today.