Is your purchase mechanism making your business unproductive? Issues like late approvals, duplicate invoices, untracked spend, and missed discounts are ones that businesses would like to dodge, but still, they persist and affect many. It’s not that you are doing something wrong. These issues come up due to a broken or loosely managed procure-to-pay process.

Unfortunately, these challenges in the procure-to-pay process have pushed the business cost up by 20% for most of the businesses, according to McKinsey. Such a situation is unsustainable in the era of tight margins, digitization, and labor shortages, thus making streamlining of the procure-to-pay process important.

In this guide, we will explain what the process will look like in 2026, how it will operate, what mistakes businesses make, and how you can reduce costs through software, workflows, and support.

What is Procure-To-Pay Process 2026

Procure-to-pay process, also known as purchase-to-pay or procurement-to-payment, is an end-to-end process followed by businesses for purchasing, receiving, and paying for goods or services. This process covers everything from identifying a purchasing need all the way to issuing payment to the supplier.

The aim of this process is to connect procurement, finance, and accounting into one continuous workflow, ensuring all purchases are:

- Approved properly

- Recorded accurately

- Paid on time

- Fully auditable

While the traditional job of the procure-to-pay process is to process purchase orders and invoices, in 2026, its importance has increased for its contribution to visibility, compliance, and financial discipline.

A modern procure-to-pay workflow aligns with:

- Internal controls

- US accounting standards (GAAP)

- Tax and reporting requirements enforced by the Internal Revenue Service

- Audit readiness expectations

2026 is the year when businesses are to have clear documentation, approval trails, and correct expense classification, not just for being audit-ready but for making daily informed financial decisions.

Key Stages of the P2P Workflow

A typical P2P workflow includes the following stages:

- Purchase request initiation

- Approval based on budget and authority

- Purchase order creation

- Goods or services receipt

- Invoice capture and validation

- Three-way matching (PO, receipt, invoice)

- Payment processing

- Reconciliation and reporting

Each stage is an opportunity either to control costs or to lose them.

Benefits of an Effective P2P Workflow

When you implement an effective procure-to-pay workflow, you will enjoy benefits beyond the accounts payable function. A well-structured procure-to-pay process connects procurement, finance, and accounting, turning purchasing from a reactive task into a controlled operation.

Here’s how an effective procure-to-pay workflow makes a real difference.

Better Spend Visibility Across Departments

Lack of centralized procure-to-pay workflow leads to spending in silos. Each of your departments will independently make purchases, approvals will be informal, and you will not have a clear view of where the money is going.

An effective procure-to-pay process provides real-time visibility into:

• Who is spending?

• What is being purchased?

• Which vendors are being used?

• How spend aligns with budgets?

Such transparency helps in identifying opportunities to do cost savings, enforce purchasing policies, and avoid sudden expenses.

Reduced Duplicate and Erroneous Payments

Manual invoicing will give rise to duplication or paying the wrong amount. It can be countered through a structured procure-to-pay workflow that introduces controls like:

- Standardized invoice capture

- Three-way matching (purchase order, receipt, invoice)

- Automated validations

- These controls reduce overpayments, billing errors, and costly corrections.

Stronger Compliance and Audit Trails

You will be held to higher standards when it comes to maintaining records. These records will be used for internal audits, external audits, and regulatory reviews.

With an effective procure-to-pay workflow, you can create:

- Clear approval histories

- Documented purchasing decisions

- Traceable payment records

With perfect records, you strengthen compliance and make audits stress-free and quick.

Faster Invoice Processing and Approvals

When delays in approvals and invoice processing take place, cash flow and vendor relationships get strained.

With a streamlined P2P workflow:

- Approvals move faster through defined workflows

- Bottlenecks are easier to identify

- Invoices are processed on time

Fast approvals and invoicing mean a reduction in late payments and help you take advantage of early payment discounts.

Improved Vendor Relationships

Your vendors need predictability, especially in their payments, which improves their trust in you.

An effective procure-to-pay process supports:

- On-time payments

- Fewer invoice disputes

- Clear communication

When your vendors trust you with regard to payments, you will get better terms, improved services, and even flexibility from their side.

More Accurate Financial Reporting

Procure-to-pay directly feeds into accounting systems, which, if well-managed, can improve data accuracy across financial reports.

This results in:

- Cleaner general ledger entries

- More reliable expense classification

- Better month-end close processes

Accurate reporting supports confident decision-making and financial planning.

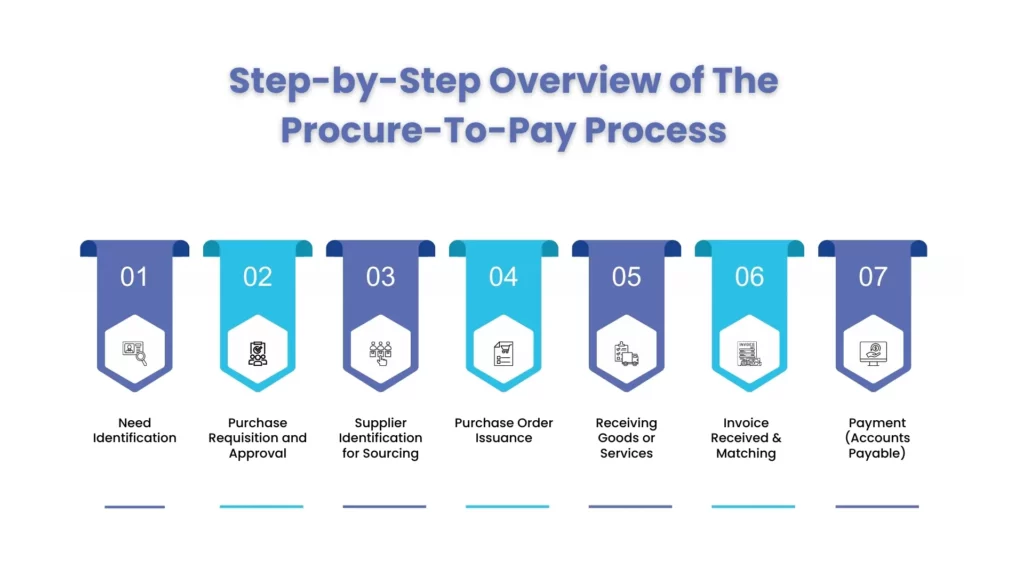

Step-by-Step Overview of The Procure-To-Pay Process

The procure-to-pay process contains multiple steps that must be followed sequentially, covering procurement to accounts payable. Many businesses have made their variations to meet their requirements, but the P2P process generally includes the following key steps:

Need Identification

The process begins when you need a product or a service, for example, you may need a raw material. The requirement must be defined clearly (quantity, specifications), which will ensure an accurate purchase.

Purchase Requisition and Approval

The next step is to formalize the need into a purchase requisition. Under it, details would be needed, like what’s needed, why, the estimated cost, and the desired vendor if known. It must be sent for approvals, and once it is approved by you or the budget owners, it will move forward. This control step helps in preventing unauthorized or off-budget spending.

Supplier Identification for Sourcing

In multiple cases, your prefeed vendor may not have the products or services you need. In such situations, your team must identify potential suppliers and get their quotes. Under this step, your team member will be comparing price, quality, and delivery times. If your existing vendor already has the items you need, then this step can be skipped.

Purchase Order Issuance

After approval and selection of the supplier, a purchase order must be created. It’s a formal order issued to the supplier, and it has the exact details of the item or service being purchased. The details include quantity, price, delivery date, delivery address, and other terms and conditions. This step is crucial as it forms a binding agreement: the supplier will reference the PO when fulfilling the order.

Receiving Goods or Services

Based on the purchase order (PO), the supplier will send the goods or services, and once they are received, they must be verified with the PO for their quality and quantity. Any discrepancies must be communicated promptly to the supplier for resolution.

Invoice Received & Matching

Once the product or service is delivered, the supplier will issue you an invoice to request payment. The invoice must match the PO; if it’s a match, then payment is approved. If discrepancies are found, then they must be highlighted. It can be said that it is the most time-consuming part of the process, if it is done manually, but it is also the most crucial one to prevent fraud or overspending.

To save time, energy, and resources from getting consumed in this step and in the whole process, many businesses have started availing the procure-to-pay services offered by professional accounting service firms.

Payment (Accounts Payable)

Once the invoice is approved, the final step is to pay your supplier. This step can be automated, and the transaction must be recorded in the financial system. With this step, the procure-to-pay process is completed.

For Example

Suppose a global enterprise “XYZ Airlines Group” operates across multiple US states and needs to purchase $2 million worth of aircraft spare parts for routine maintenance.

The maintenance department raises a purchase request with detailed specifications and urgency level. Because it’s high-value spend, approvals go through multiple levels (Department Head → Finance Controller → Procurement Director). Procurement then invites bids from approved suppliers and finalizes the vendor based on price, compliance, delivery capacity, and contract terms.

Once the supplier is selected, XYZ issues a formal Purchase Order (PO). When parts arrive at the central warehouse, the receiving team verifies quality and quantity, and logs a Goods Receipt Note (GRN) in the ERP system (like SAP/Oracle). The supplier sends an invoice, and Accounts Payable processes payment only after three-way matching (PO + GRN + Invoice). After approval, payment is released and recorded.

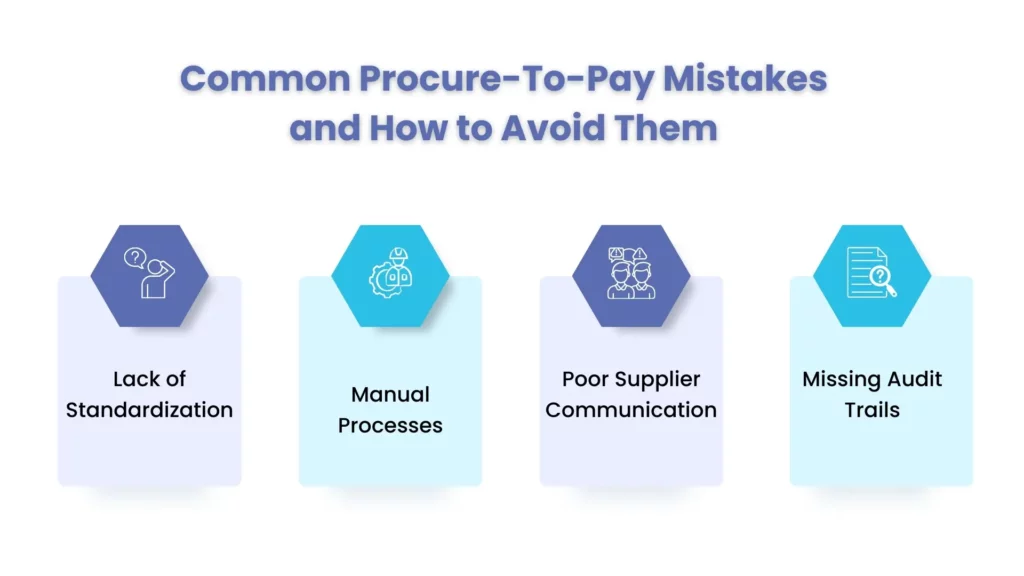

Common Procure-To-Pay Mistakes and How to Avoid Them

The procure-to-pay process is a time-consuming and complex one, and even professional enterprises have faced challenges within it. That’s why we are highlighting some of those common pitfalls and ways to overcome them.

Lack of Standardization

Lack of centralized workflow across your departments causes a lot of bottlenecks. Therefore, focus on implementing a clear procure-to-pay process and standardizing the whole workflow.

Manual Processes

It will be risky to rely on spreadsheets or paper-based systems due to errors and delays. Automation tools should be used for streamlining procurement, invoicing, and approvals.

Poor Supplier Communication

Lack or poor communication creates misunderstanding with your vendors. Therefore, relationships must be strengthened with constant updates and performance feedback.

Missing Audit Trails

Without proper records, you will be risking non-compliance. Therefore, use accounting software and other tools to log every transaction step automatically.

Avoiding these issues early can significantly improve efficiency and transparency across procurement.

Is Procure-To-Pay Software Right for My Business?

It must be said that you cannot handle the procure-to-pay process without using procure-to-pay software. But a question comes up: Is procure-to-pay software right for my business?

Here are some steps you can follow to determine if procure-to-pay (P2P) software is suitable for your business:

Evaluate Your Current Procurement Processes

Identify the strengths and weaknesses of your current procurement process. Identify the areas that need automation and can save time and reduce errors.

Analyze Your Procurement Volume

Know the volume of transactions your business does. If your business is conducting a high volume of transactions, then automating the process through software makes sense.

Assess Your Budget

Is your budget sufficient for supporting the implementation of P2P software? Buying software involves the costs of the software, implementation, and training. Also, take its maintenance and support fees into consideration.

Identify Your Requirements

Focus on your specific procurement needs and requirements. Consider what you need and work with your suppliers. Based on that, you can decide the automation you need.

Research P2P Software Solutions

Research multiple P2P software solutions available in the market and compare them based on your requirements and budget.

How Does Procure-To-Pay Software Work?

Procure-to-pay software helps make your purchasing process smoother and faster by integrating with your financial systems. When you are ready to buy goods and services, the software will guide you so that your choice aligns with the policies set by you.

Once the order is placed, the software will generate the purchase order and send it for approval. Once approved, the purchase order will be sent to the supplier. After placing the order, the software will track the delivery and receipts. Once the delivery is done, the software will check the invoices for accuracy by matching them with the purchase order before making payments.

Best P2P software platforms

Vendr – Vendr (that’s us!) is a SaaS buying platform that helps procurement teams save money, manage contracts and renewals, and build long-term strategic relationships with software vendors.

Procurify – Procurify is a user-friendly procure-to-pay (P2P) platform that helps teams control spend by managing purchase requests, approvals, and budgets in one place.

SAP Ariba – SAP Ariba is a leading spend management and e-procurement tool within SAP’s suite, widely recognised as a top P2P platform and regularly ranked a Gartner Magic Quadrant leader.

How Corient Can Help You

We understand the time-consuming nature of procure-to-pay process and time is in short supply, especially when you are in cut throat competition. In such a situation, you will need the assistance of a professional accounting service firm like Corient.

Corient is in the business of helping US businesses in streamlining their procure-to-pay process through structured procure to pay services delivered as part of end-to-end finance and accounting services.

Corient supports businesses by:

- Designing and managing P2P workflows

- Handling invoice processing and matching

- Improving approval and payment controls

- Integrating P2P into broader Record-to-Report processes

- Delivering Affordable Accounting Solutions without sacrificing control

The result of our services is lower operating costs, better compliance, and clearer financial visibility.

People Also Ask :

How does P2P reduce costs?

A fine-tuned procure-to-pay process will modernize purchasing activities, strengthen financial management, and develop strong supplier relations. It will lead to a lot of cost savings through improved negotiations with suppliers, efficient inventory management, and timely payments.

What is the process of procure-to-pay?

Procure-to-pay (P2P) is simply the step-by-step process a business follows when it needs to buy something—starting from requesting and approving the purchase, placing the order, receiving it, checking the invoice, and finally paying the supplier.

How does P2P support compliance?

Through the procure-to-pay process, you can create clear approval trails and accurate records, thus keeping your business documents audit-ready.

Is procure-to-pay software mandatory?

While it’s not compulsory, using a procure-to-pay process software will help your business in handling high volumes of purchases and control it effectively.

How is P2P different from purchase-to-pay or order-to-cash?

Procure-to-Pay (P2P) vs Purchase-to-Pay

There’s no real difference—both terms are usually used interchangeably. They cover the same process:

request → approval → purchase order → receipt → invoice → payment.

P2P vs Order-to-Cash (O2C)

This is the opposite side of the business flow:

P2P = buying and paying suppliers

O2C = selling to customers and collecting money

So, P2P is procurement/AP focused, while O2C is sales/AR focused.

Conclusion

Gone are the days when the procure-to-pay process was considered a back-office operation. In recent years, it has turned into a lever for controlling your business. When it is structured properly, it reduces waste, strengthens compliance, and improves cash flow. When neglected, it quietly erodes margins and creates unnecessary risk.

Many businesses have invested in the process internally to stay compliant, but many have chosen the path of partnering with accounting firms to get the job done. If you are thinking of choosing to sublet the P2P process task, then Corient is at your service.

Feel free to use our contact form to share your needs, and we will come up with optimized solutions.